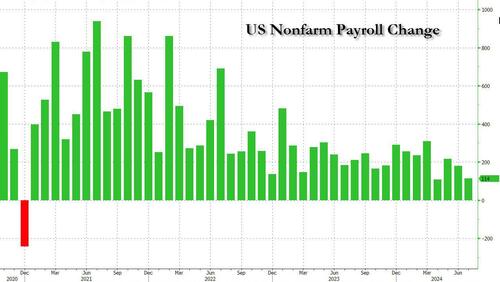

In our payrolls preview last night we asked ” just how bad will it get“, and we got the answer moments ago when the BLS reported that in July, the US added just 114K payrolls, a huge miss to expectations of 175K and also a huge drop from the downward revised June print of 206K, now (as always ) revised to just 179K. This was the lowest print since December 2020 (at least prior to even more revisions)…

… and a 3 sigma miss to the median estimate of 175K.

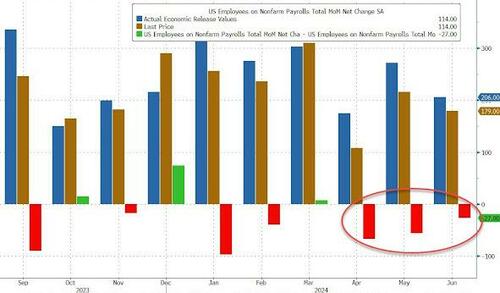

Of course, these being numbers published by the corrupt Biden, pardon Kamala Department of Goalseeked bullshit, the previous months were revised lower as usual, with May revised down by 2,000, from +218,000 to +216,000, and the change for June was revised down by 27,000, from +206,000 to +179,000. With these revisions, employment in May and June combined is 29,000 lower than previously reported. It gets better because as shown in the next chart shows, 5 of the past 6 months have now been revised lower.

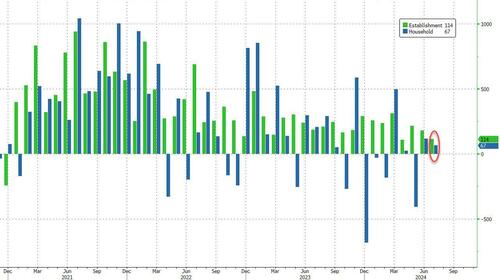

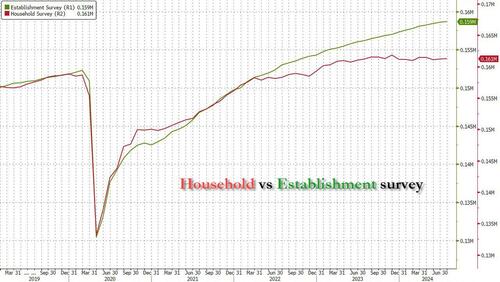

Unlike previous months when the Household and Establishment survey diverged massively, this time the two numbers at least had the same sign, even if the number of people employed (per the Household survey) rose half the number of payrolls, up just 67K…

… which means that while the fake Payrolls print is now finally topping, the number of actually employed workers hasn’t changed in the past year as shown below.

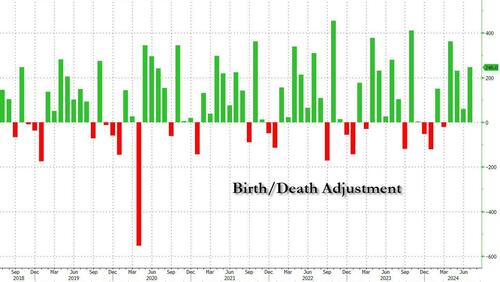

Of course, we can’t possibly forget that every jobs number is highly manipulated and rigged, and July was no difference with the Birth/Death model adding a ridiculous 246K “statistical” jobs to the unadjusted print. Which it does not translate apples to apples, one can confidently say that the actual adjusted payrolls number would be far, far smaller had it not been for this ongoing fabrication.

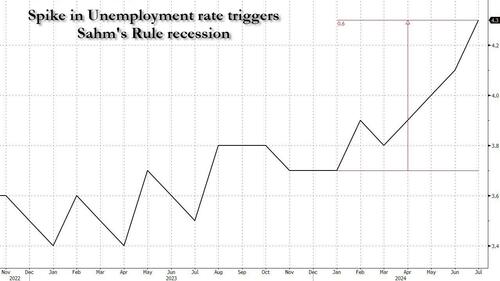

But while we have long known that the real payrolls number is far worse than reported, what was the true shock in today’s “data” is the long overdue admission that the US is effectively in a recession because as the rule named for pro-Biden/Kamala socialist Cluadia Sahm indicates, a recession has now been triggered. The rule, for those who don’t remember is that a recession is effectively already underway if the unemployment rate (based on a three-month moving average) rises by half a percentage point from its low of the past year. And that’s what just happened, with the unemployment rate surging 0.6% from the year’s low.

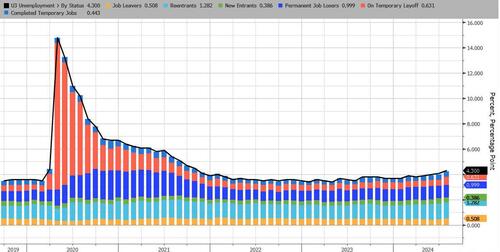

One thing to note here is that the unemployment rate of 4.3% was boosted 0.2% by people on temporary layoffs which increased by 249,000; this was mostly due to Hurricane Beryl, so expect the unemp rate to slide back to ~4.1% next month unless of course it is the Democrat’s strategy to go into elections with a Sahm recession in hand

As for major ethnic groups, the unemployment rate rose across the board (except Blacks) with the Hispanic unemployment rate hitting the highest in two years.

Elsewhere, the labor force participation rate, at 62.7%, was up 0.1% from 62.6% the previous month and above the expectation for an unchanged print.

Some more details from the report:

- The number of people employed part time for economic reasons rose by 346,000 to 4.6 million in July. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs.

- The number of people not in the labor force who currently want a job increased by 366,000 to 5.6 million in July, largely offsetting a decline in the previous month. These individuals were not counted as unemployed because they were not actively looking for work during the 4 weeks preceding the survey or were unavailable to take a job.

- Among those not in the labor force who wanted a job, the number of people marginally attached to the labor force, at 1.6 million, was little changed in July. These individuals wanted and were available for work and had looked for a job sometime in the prior 12 months but had not looked for work in the 4 weeks preceding the survey. The number of discouraged workers, a subset of the marginally attached who believed that no jobs were available for them

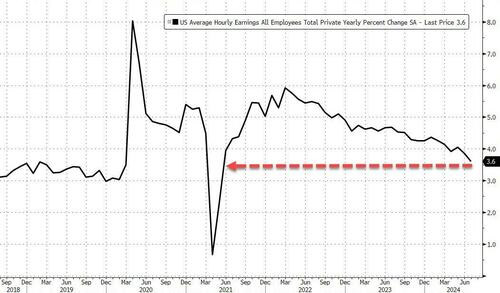

With jobs disappointing, wages predictably also cooled off more than expected, and in July the monthly increase in average hourly earnings rose was just 0.2%, below the 0.3% expected and below last month’s 0.3%. On an annual basis, the 3.6% growth rate also missed expectations of 3.7%, and dropped from a downward revised 3.8%.

The average workweek for all employees on private nonfarm payrolls edged down by 0.1 hour to 34.2 hours in July. In manufacturing, the average workweek edged down by 0.2 hour to 39.9 hours, and overtime edged down by 0.1 hour to 2.8 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls edged down by 0.1 hour to 33.7 hours.

In other words, when factoring in for the big drop in hours worked, the average hourly earnings growth was even lower, comeing somewhere around 3.4%-3.5%

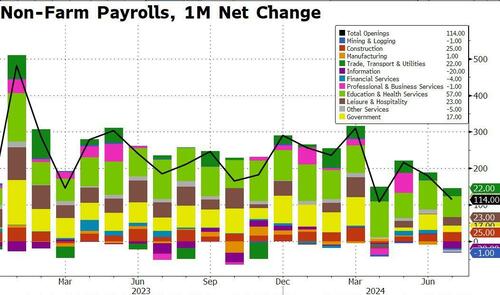

Looking at the composition of the reported jobs, we find employment continued to trend up in health care, in construction, and in transportation and warehousing, while information lost jobs.

- Health care added 55,000 jobs in July, similar to the average monthly gain of 63,000 over the prior 12 months. In July, employment rose in home health care services (+22,000), hospitals (+20,000), and nursing and residential care facilities (+9,000).

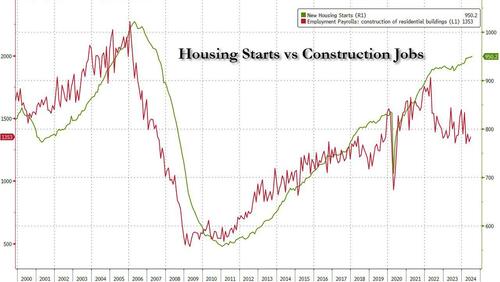

- Construction employment in July (+25,000), in line with the average monthly gain over the prior 12 months (+19,000). Employment in specialty trade contractors continued its upward trend in July (+19,000). Good luck with this considering the epic crash in new housing starts.

- Employment continued to trend up in transportation and warehousing (+14,000), with job gains in couriers and messengers (+11,000) and warehousing and storage (+11,000). These gains were partially offset by a job loss in transit and ground passenger transportation (-11,000). Transportation and warehousing has added 119,000 jobs since a recent low in January of this year.

- Employment in social assistance continued its upward trend in July (+9,000), but at a slower pace than the average monthly gain over the prior 12 months (+23,000).

- Information employment declined by 20,000 in July but has changed little over the year.

- Government employment was little changed in July (+17,000). Employment growth in government has slowed in recent months, following larger job gains in 2023 and the first quarter of 2024.

- Employment showed little change over the month in other major industries, including mining, quarrying, and oil and gas extraction; manufacturing; wholesale trade; retail trade; financial activities; professional and business services; leisure and hospitality; and other services.

And visually:

Commenting on the report, the Bloomberg economist team had this to say:

“July’s nonfarm payrolls suggest the cooling in the labor market shows few signs of stabilizing – and isn’t gradually ‘normalizing,’ as Powell characterized it after the July 31 FOMC decision.

“Some of the weakness in payrolls can be attributed to Hurricane Beryl — but not all — and in any case the storm impact should reverse in coming months. However, the surprisingly sharp increase in the unemployment rate was due primarily to layoffs and people taking longer to find jobs, not weather.

“Furthermore, with the Bureau of Labor Statistics’ ‘birth-death model’ still overstating employment from the net creation of new firms, we think the underlying pace of monthly job growth is likely less than 100k — below the pace consistent with a steady unemployment rate. We expect the unemployment rate to continue rising, reaching to 4.5% by year-end. Not only is a September rate cut likely — even a 50-basis point cut is now in play.”

And here is RBC analyst Janet Mui agreeing that a 50bps rate cut is now in play: “Taken together with the higher jobless claims, contraction in the manufacturing hiring survey and July’s jobs report, it is likely that the Fed will start cutting interest rates next month and there is expectation that it may need to cut more aggressively than previously penciled in. Risk assets are reacting negatively given the growth concerns while bonds/gold/defensive sectors are rallying as investors seek safe havens.”