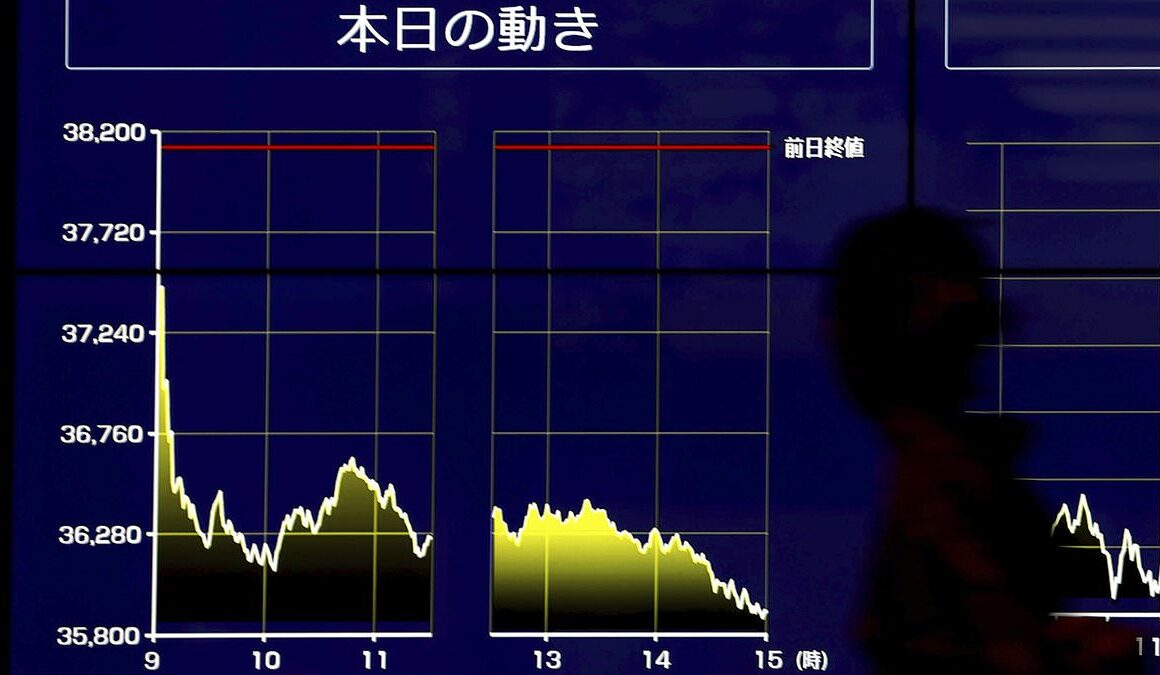

Tokyo’s stock market nosedived more than 12 per cent this morning in the latest bout of sell-offs to shake world markets as investors fret over the state of the US economy.

The benchmark Nikkei 225 index suffered its largest points drop in history, plunging 12.40%, or 4,451.28 points, to 31,458.42 as the broader Topix index lost 12.23%, or 310.45 points, to 2,227.15.

By the close on Monday, the index had wiped out 113 trillion yen ($792.32 billion) of the Nikkei market value since July 11, when it peaked at 42,426.77 – a drop of 27%.

It comes after a solemn Friday on Wall Street where the Dow Jones Industrial Average finished down 1.5% as data showed the US jobs market cooled much more than expected in July.

European stock markets also closed sharply in the red at the end of last week.

The benchmark Nikkei 225 index suffered its largest points drop in history, plunging 12.40%, or 4,451.28 points, to 31,458.42 as the broader Topix index lost 12.23%, or 310.45 points, to 2,227.15

Japanese Finance Minister Shunichi Suzuki declared today the government was cooperating with the central bank and closely monitoring markets with a sense of urgency.

‘It’s hard to say what is behind the decline in stocks,’ Suzuki told reporters, adding that authorities were watching stock market moves with ‘grave concern’.

Poor jobs data and speculation that the US is headed for a recession sent world markets plunging last week.

But Japan’s stocks were hit particularly hard, with concern over the US economy compounded as the Japanese yen rallied to seven-month highs versus the dollar.

In an attempt to calm volatility in the market, futures trading was suspended for 10 minutes as a so-called ‘circuit-breaker’ on the Nikkei and Topix indexes on the Osaka Exchange in Japan’s western metropolis, an exchange official said.

Worries over weakness in the US economy and volatile markets have rippled around the world, even though the US economy is still growing, and a recession is far from a certainty.

Elsewhere in Asia, Hong Kong’s Hang Seng index lost 2.5% to 16,519.78 and the S&P/ASX 200 in Australia declined 3.8% to 7,637.40.

The latest setback has been particularly damaging for markets heavily weighted toward computer chipmakers like Samsung Electronics and other technology shares: on Monday, South Korea’s Kospi plummeted 9.3% as Samsung’s shares sank 11.6%.

Taiwan’s Taiex also crumbled, losing 8.4% as Taiwan Semiconductor Manufacturing Co, the world’s biggest chip maker, dropped 9.8%.

Semiconductor shares plunged with Tokyo Electron nosediving 18.48% to 22,055 yen and Advantest tumbling 15.84% to 5,313 yen.

Toyota plummeted 13.65% to 2,232 yen.

A man is reflected on an electric stock quotation board outside a brokerage in Tokyo

The Bank of Japan last week raised interest rates for the second time in 17 years, with talk of another rate hike to come, while the US Federal Reserve has hinted at a cut as soon as September.

Daiwa Securities said the losses in Tokyo reflected ‘deepening concerns over the uncertain US economy’.

‘Investor sentiment was down as the US employment data for July came in lower than expected, raising fears that the US economy is slowing more than expected,’ IwaiCosmo Securities said.

‘The market was also weighed down by the yen’s appreciation against the dollar and as expectations for exporters’ upbeat financial results receded,’ the brokerage added.

‘The rapid move in the yen is putting downward pressure on Japanese equities, but it’s also driving an unwind of a major carry trade – investors had leveraged up by borrowing in yen to buy other assets, chiefly US tech stocks,’ said Kyle Rodda, a senior financial market analyst at Capital.com in Melbourne.

‘We are basically seeing a mass deleveraging as investors sell assets to fund their losses.’