While homes in San Francisco typically sell for far north of $1 million, home shoppers might be shocked to see that a two-bedroom in the posh Ghiradelli Square area was recently listed for a mere $168,000.

So what’s the catch? Only one-tenth of this pretty waterfront property is for sale.

This condo is being sold as a “fractionally owned property,” where multiple people sign on as owners in exchange for access to the property for several weeks a year.

“Indulge in the best of San Francisco living with fractional ownership,” the listing says. “With this 1/10th deeded fractional ownership, you have access to an array of stunning 2-bedroom, 2-bath residences for 35 days out of each year.”

Co-ownership or fractional ownership has become an increasingly popular way for people to own a portion of an investment property or vacation home. Depending on the property, it might involve splitting a home cost in half, or splitting it with more than a dozen people.

And while it sounds similar to a timeshare model, it’s functionally very different.

(Realtor.com)

Fractional ownership vs. timeshares

Fractional ownership or co-ownership differs from a traditional timeshare model in terms of the access you have to a property. With timeshares, you’re purchasing the right to use a property for a set amount of time each year—not the property itself. With fractional ownership, you own a portion of the deeded property, which comes with many more advantages than a timeshare arrangement.

“Fractional ownership is a much greater form of direct ownership,” says Nicholas Ritacco, portfolio manager and director of finance at IB Global Real Estate Funds. “From an appreciation and improvement standpoint, you have much better control over monetizing the asset and increasing its value in the long term.”

Most people in the fractional ownership game do so for secondary or rental properties that they might visit for only a few weeks a year anyway. This way, buyers aren’t saddled with a whole vacation home that sits empty most of the year when they’re not there. They also don’t have to deal with the headaches of trying to rent it out on Airbnb or other short-term rental sites.

“You’re not burdening yourself with any additional expenses or more home than you actually need,” says Ritacco, who likes fractional investing because it allows people to “right-size” their homeownership. “It’s ideal for a vacation home where your time at the property is generally limited or something that can be structured to be shared.”

And unlike timeshares, which are notoriously difficult to sell, fractional ownership properties are relatively easy to unload. Plus, if the property has risen in value, you gain equity the longer you hold it.

“Your share is real property, not simply a block of time,” says Austin Allison, CEO of the fractional ownership company Pacaso. “And because it’s a real estate asset, its value will move with the market—which means that any equity realized is yours. When you purchase a timeshare, you typically own the right to use the property for a period, not the property itself, which is another reason why buyers are choosing to co-own rather than purchase a timeshare.”

Part-ownership of part-time property

(Realtor.com)

Like timeshares, fractional ownership is great for people who have “an interest in maintaining a second home and not occupying it full time,” says Laguna Coast real estate agent Cynthia Ayers.

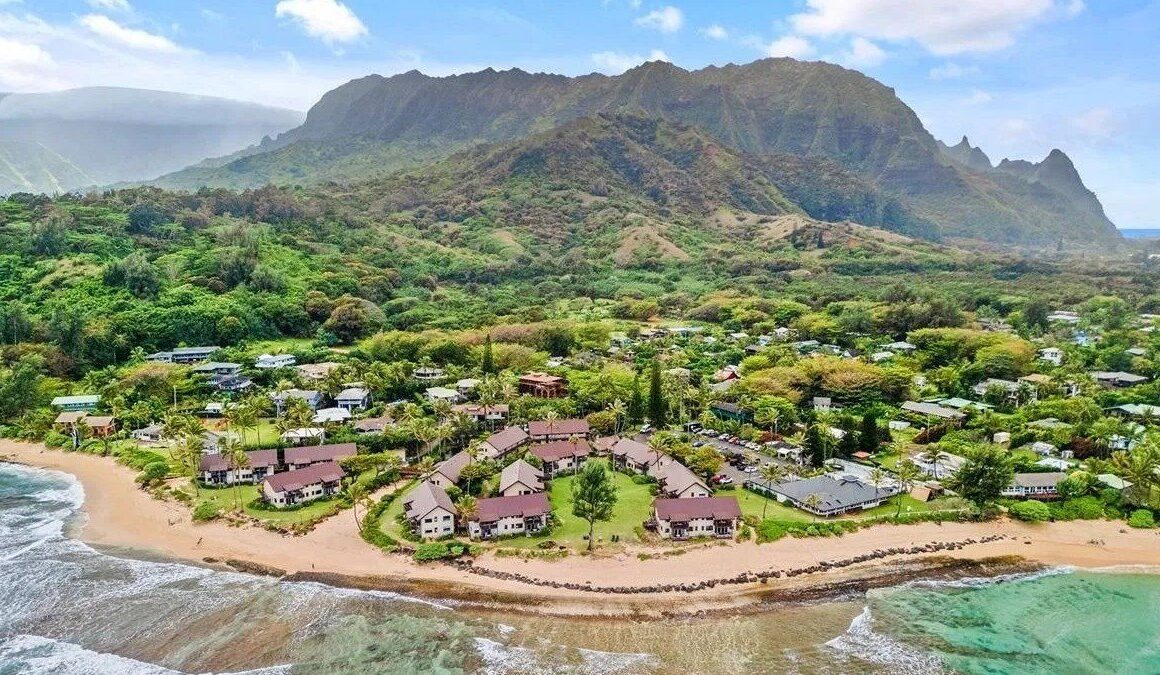

People often opt for fractional ownership because it provides a lower barrier to entry in markets that might otherwise be off-limits. Fractional homes are popular in expensive vacation spots: Big Bear, CA, has several fractional properties available, as do the Hawaiian islands.

The amount of access you might have with fractional ownership varies greatly. For instance, Ayers has a client who’s been renting out her second home, a four-bedroom, five-bath beachfront property, to both long- and short-term tenants. But now she’s looking to sell half of it and have access to it six months out of the year.

(Realtor.com)

(Realtor.com)

“It’s been a very good income-generating property for the owner,” she says. But, “she’s not really wanting to do it all by herself now. The truth is that she would prefer just to have her six months and not have to worry about monitoring the bookings and things like that.”

To simplify her life, Ayers’ seller is hoping she can find someone to split the property and is offering it for below market value. Though the home was appraised at $6 million, according to Ayers, the half-stake in the property is going for just $2.5 million—still a chunk of change—but a buyer would be getting $500,000 in equity upfront.

This type of fractional ownership is fairly rare. Typically, fractional homeownership involves multiple people, as in the case of one Key Largo, FL, compound (shown below), which is currently offering a deeded stake for $249,000. Each of the six fractionally owned homes has eight owners who have access to the properties for a minimum of 48 days per year. The recently renovated homes include the use of two boats, a gym, and a pool with private cabanas.

(Realtor.com)

And many fractional properties come complete with managers that help maintain homes and arrange schedules.

With so many people trying to plan vacations, you’d think it would be a nightmare, but Chris Minnix, the Key Largo compound’s former manager, says they have property reservations down to a science.

“We take the whole month of September and facilitate this and lay it out,” he says. “It’s much easier for us because we’ve been doing it for so long.”

Fractional ownership offers luxury for less

(Realtor.com)

Proponents of fractional ownership say it gives people access to properties that they might not otherwise be able to afford. Each of the homes in the Key Largo compound is worth anywhere from $2 million to $4 million.

“You’re getting the luxury of a multimillion-dollar home for, you know, a couple $100,000—looking out at the water every day, having the boat at your fingertips, a private dock, a huge pool with private Tiki huts,” Minnix says. “So I would say you’re getting the bang for your buck.”

It’s also allowing people who might not otherwise be able to break into real estate investing to have the chance to take part in the market, says Ritacco.

Fractional ownership property investment companies have been springing up over the past several years. Companies like Fundrise and CrowdStreet allow individual investors to buy shares of residential and commercial real estate portfolios, not individual properties.

How to invest in fractional ownership of a home

(Realtor.com)

If you’re thinking about fractional ownership, you should know that you’re typically required to put down more money upfront—between 20% and 50%. You can also finance the home through a home equity agreement, home equity line of credit, or a cash-out refinance.

Companies like Pacaso have sprung up to manage fractional ownership agreements, but you should also consider if you’re comfortable sharing a home with someone else. How would you deal with conflicts over property maintenance or conditions?

Ritacco recommends that people thinking about fractional ownership do due diligence on “the expectations of the property’s future from an improvements standpoint and an operational standpoint. Give yourself enough structure to feel secure, but not too much that it’s overburdensome to operate the property.”