Topline

Democrats are expected to attack former President Donald Trump’s views on Social Security and Medicare next week at the Democratic National Convention, even as the ex-president has publicly vowed not to cut the entitlement programs—though the plans he has announced for Social Security are likely to deplete the programs’ funds sooner than expected.

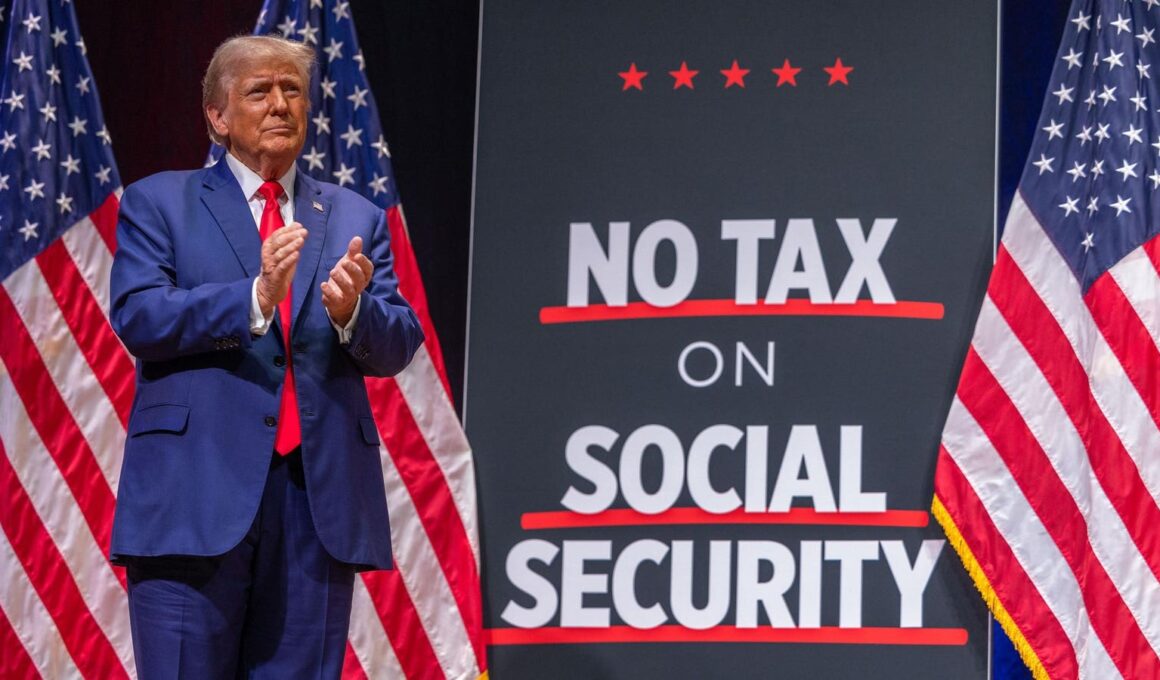

Former President Donald Trump speaks at a campaign rally on August 14 in Asheville, North Carolina.

Key Facts

Trump and the Republican Party have publicly committed not to cut Social Security or Medicare if Trump wins the White House, with the GOP’s platform stating the party will “fight for and protect Social Security and Medicare with no cuts, including no changes to the retirement age.”

Democrats have seized on comments Trump made in March, however, when the ex-president suggested he was open to cutting Social Security and Medicare, telling CNBC, “There is a lot you can do in terms of entitlements, in terms of cutting and in terms of also the theft and the bad management of entitlements.”

Trump’s campaign argued the ex-president did not mean to insinuate he wanted to cut entitlement programs, with spokesperson Karoline Leavitt telling CNN he was “clearly talking about cutting waste, not entitlements” and saying Trump “will continue to strongly protect Social Security and Medicare in his second term.”

Trump has proposed eliminating the tax on Social Security benefits that many seniors pay, as under current tax rules, Social Security recipients are taxed on a certain percentage of their benefits, which varies based on income.

Tax experts have broadly criticized Trump’s proposal, however, with the Committee for a Responsible Federal Budget projecting that exempting taxes on benefits would result in Social Security and Medicare receiving $1.6 trillion less in revenue between 2026 and 2035 than if the current rules stayed in place.

If that lost tax revenue isn’t made up through other funding sources, that means those programs will run out of money and become insolvent sooner: Social Security’s Old Age and Survivors’ Insurance fund would become insolvent in 2032, according to the CRFB—one year sooner than projected under the current rules—while Medicare would become insolvent in 2030, which is six years sooner than currently projected.

Get Forbes Breaking News Text Alerts: We’re launching text message alerts so you’ll always know the biggest stories shaping the day’s headlines. Text “Alerts” to (201) 335-0739 or sign up here.

Chief Critic

Leavitt told Forbes Trump “will continue to strongly protect Social Security and Medicare in his second term” when asked about the criticism of his plan to eliminate taxes on Social Security benefits, claiming “the only candidate who poses a threat to the solvency of Social Security is dangerously liberal Kamala Harris.” She argued that Trump’s proposals on boosting energy production and cutting regulations will “put Social Security on a stronger footing for generations to come, all the while eliminating taxes on Social Security for America’s well-deserving seniors.”

Surprising Fact

In addition to draining the U.S.’s Social Security and Medicare funds more quickly, tax experts project Trump’s proposed tax cut on Social Security would not provide that much benefit to middle-class Americans. Social Security recipients who earn between $32,000 and $60,000 annually would only save approximately $90 in taxes, according to the Urban Institute and Brookings Institution’s Tax Policy Center, while the 1% of earners who make $5 million or more would receive $2,500. The lowest-income Americans who earn less than $32,000 already aren’t taxed on their Social Security benefits, so they wouldn’t see a change.

What Does Kamala Harris Say About Social Security?

Harris has not yet unveiled a specific proposal involving Social Security, but she has championed the program as vice president and the Biden administration has supported it without proposing any cuts. She also co-sponsored legislation in the Senate that would expand Social Security, including by increasing benefits for some beneficiaries, changing how cost-of-living adjustments are calculated and allowing some dependents to receive benefits while they’re full-time students through age 22. The legislation would also raise more money for Social Security by expanding the payroll tax to higher incomes. It’s unclear if Harris supports those same policies in her presidential campaign, however, and she did not address Social Security in a speech Friday about her economic policy agenda.

What About Project 2025?

Harris and other Democrats have pointed to Project 2025 to suggest Trump would cut Social Security and Medicare if elected. The document, a 900-page policy agenda spearheaded by the Heritage Foundation and other right-wing groups, proposes a total overhaul of the executive branch by the next conservative administration. “Just look at his Project 2025 agenda,” Harris said in a speech that was also shared online by her campaign. “If he is elected, Donald Trump … intends to cut Social Security and Medicare.” Project 2025 does not explicitly call for fully cutting Social Security or Medicare, though it does propose reforms to Medicare that include making Medicare Advantage, a paid supplement to Medicare, the “default enrollment option.” Trump and his campaign have publicly disavowed any connection to Project 2025—though he does have links to the Heritage Foundation and has praised its work in the past—and he would not be under any obligation to follow its policy agenda if elected.

Tangent

Trump’s vice presidential candidate Sen. JD Vance, R-Ohio, told The New York Times before he was named as Trump’s running mate that he supports raising money for Social Security through a combination of getting more men back into the workforce, increasing wages and increasing tariffs. Through that, he claimed, “I think that you buy yourself a whole hell of a lot more than the nine or 10 years that the actuaries say that we have.” It’s unclear if Trump shares those views about how to make up any potential funding gap for Social Security, though the ex-president has proposed raising tariffs on imported goods. Tax experts have suggested raising tariffs would not garner a significant amount of government revenue, however, and the amount that is raised would likely be lower than projected, because at least some Americans would stop buying imported goods since they’d be more expensive.

News Peg

Democrats will gather in Chicago next week for the Democratic National Committee, where they’re expected to attack Trump’s economic proposals and suggest he poses a threat to Social Security as they promote Harris’ candidacy. The left has ramped up its attacks on Trump over his Social Security views in recent days, putting up billboards Wednesday in Asheville, North Carolina, which specifically took aim at him over Social Security, just as Trump was set to deliver a speech there on the economy. The billboards claimed Trump plans to “slash funding, leave seniors behind, and cut taxes for the ultra-wealthy,” according to The Hill, and coincided with the anniversary of the signing of the Social Security Act in 1935. The economy has become a central issue in the November election as polls repeatedly show it’s the most important issue to voters, and Harris’ speech on the economy Friday marked the first time she’s expanded on her policy agenda as a presidential candidate.

Further Reading

Kamala Harris Addresses Economy In Speech—Here’s What To Know About Her Policy Agenda (Forbes)

Trump wants to cut taxes on Social Security — but it could threaten benefits, experts say (CNBC)

Donald Trump’s Suggestion to End Taxation of Social Security Benefits (Committee for a Responsible Federal Budget)

Exempting Social Security Benefits from Income Tax Is Unsound and Fiscally Irresponsible (Tax Foundation)