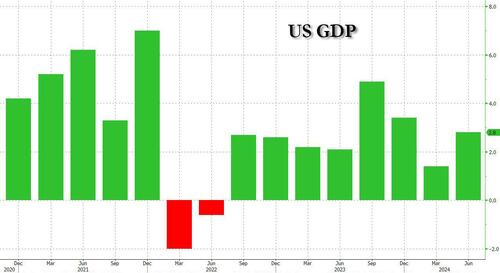

After yesterday’s panicked oped by idiot Bill “recession is here, so cut rates before Trump is elected” Dudley, expectations were for a Q2 GDP print this morning at zero if not outright negative to greenlight a July rate cut. Of course, that oped is all that was needed for Kamala’s Bureau of Economic Analysis to release a blowout print (because we now have just 100 days to establish Kamalanomics as the next sliced bread) and that’s precisely what happened moments ago when the first estimate of Q2 GDP came in at a whopping 2.8%, double the final Q1 print of 1.4% (which was already the lowest print since the technical recession in Q2 2022)…

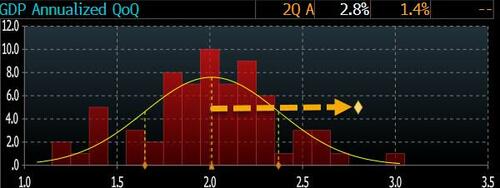

… and also came in more than 2-sigma higher than the consensus estimate of 2.0%; in fact, there was just one analyst estimate that was higher at 3.0%.

The hotter than expected Q1 print leaves H1 GDP at roughly 2.1%, a step down from the 3.1% pace of 2023.

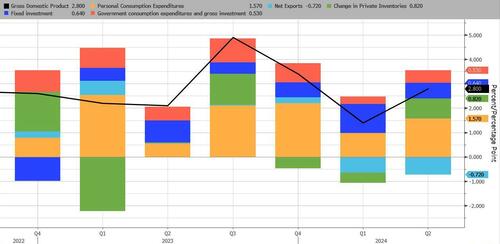

The increase in real GDP primarily reflected an upturn in inventory investment, nonresidential fixed investment, and an acceleration in consumer spending. These movements were partly offset by a downturn in housing investment.

According to UBS, details suggest very strong growth: investment rose 8.4% q/q SSAR, the highest since Q3 2023. It looks like AI-related investment supported the growth as information processing equipment rose 10.2% q/q. Personal consumption rose 2.5% in Q2, better than the decline of 2.3% in Q1. Government spending rose 3.1% q/q, higher than 1.8% in Q1.

Some more details from the BEA report, which adds Compared to the first quarter,

- The increase in consumer spending reflected increases in both services and goods. Within services, the leading contributors to the increase were health care, housing and utilities, and recreation services. Within goods, the leading contributors to the increase were motor vehicles and parts, recreational goods and vehicles, furnishings and durable household equipment, and gasoline and other energy goods.

- The increase in inventory investment was led by increases in wholesale trade and retail trade industries that were partly offset by a decrease in mining, utilities, and construction industries.

- The increase in business investment reflected increases in equipment and intellectual property products that were partly offset by a decrease in structures.

Taking a closer look at the GDP components:

- Personal Consumption contributed 1.57% to the 2.80% bottom line number, rising sharply from 0.98% in Q1.

- Fixed Investment declined to 0.64% from 1.19% in Q1

- Private Inventories added 0.82%, a sharp increase from the -0.42% destocking in Q1

- Net trade subtracted 0.71% (Driven by -0.93% contribution from imports), roughly flat with the 0.65% in Q1

- Government’s contribution to GDP rose notably from the 0.31% in Q1, to 0.53% in Q2.

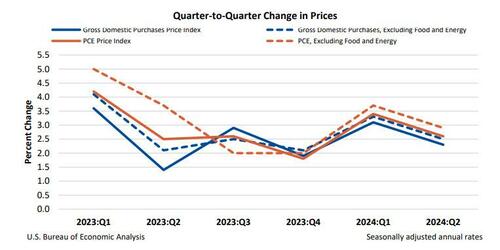

Meanwhile, core PCE index fell to 2.9% y/y from 3.7%, but higher than 2.7% consensus. We also find that headline gross domestic purchases prices increased 2.3% in the second quarter, below the 2.6% estimate, after increasing 3.1% in the first quarter.

Bottom line: as UBS concludes “This is a very good print in detail” and completely crushes the “recession is nigh” narrative set yesterday by Bill Dudley, which sparked an epic unwind in the yen carry trade, and hammered virtually all other assets as a result.