Topline

The Department of Education will start emailing eligible borrowers this week about its new student loan forgiveness plan, the agency said Wednesday, as the Biden administration moves forward with its Plan B for sweeping student debt relief after the Supreme Court struck down its initial efforts.

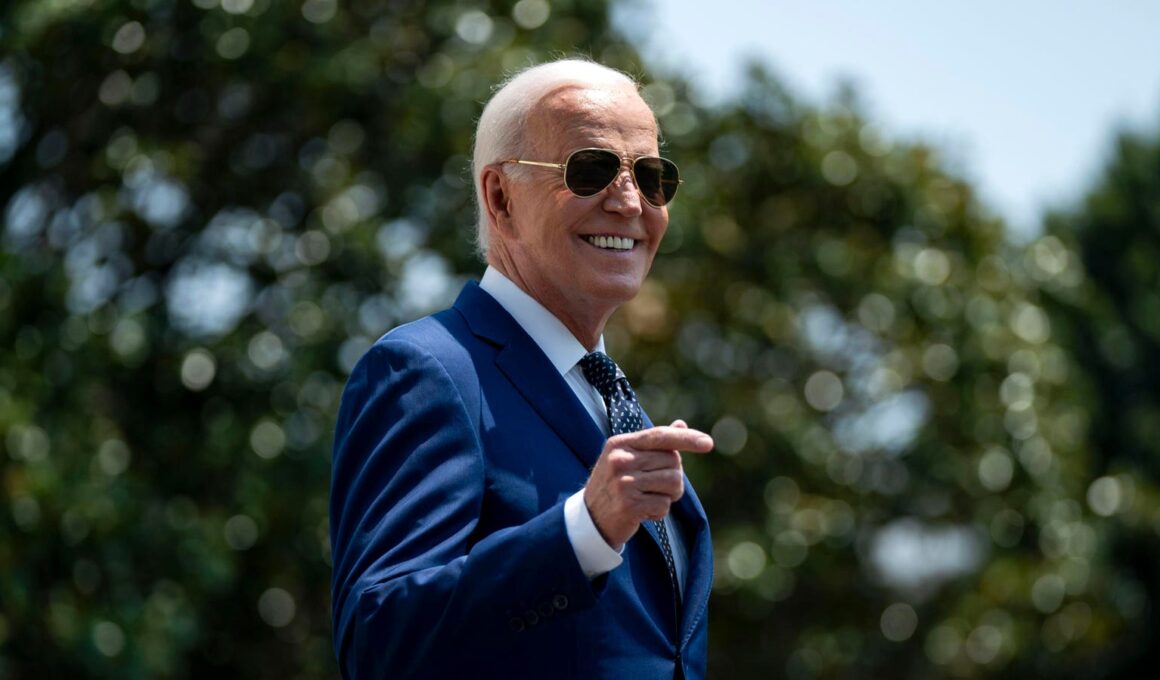

President Joe Biden departs the White House en route to Austin, Texas on July 29 in Washington, DC.

Key Facts

The Education Department will start emailing federal borrowers to let them know about its debt relief plan that was originally announced in April as it nears being finalized.

The plan is set to forgive loans for four sets of borrowers: those who now owe more than they did when they started repaying, those who have been paying off undergraduate loans for more than 20 years, those who are already eligible for existing forgiveness plans but never applied for them and those who were in “low financial-value programs” in institutions that didn’t meet the agency’s accountability standards.

The new plan is expected to take effect this fall, but the regulations are not finalized yet and it’s still possible changes could be made.

For the roughly 25 million borrowers with loan balances greater than they started with, the agency’s plan would forgive $20,000 of the difference between the starting loan amount and the current amount, or will totally forgive student loans for anyone in an income-driven repayment plan who makes $120,000 annually or less.

Borrowers who took out undergraduate loans on or before July 1, 2005, and borrowers who took out graduate loans on or before July 1, 2000, would have their debt forgiven.

Those who are eligible for relief under income-driven repayment plans but never applied for them would automatically get relief, along with borrowers who are eligible for other programs like having loans discharged if the borrower’s institution closes.

Get Forbes Breaking News Text Alerts: We’re launching text message alerts so you’ll always know the biggest stories shaping the day’s headlines. Text “Alerts” to (201) 335-0739 or sign up here.

What To Watch For

The Education Department said it will email all borrowers with at least one outstanding federal student loan about the new debt relief program, and will provide additional updates once the plan is finalized. If any borrower wants to opt out of receiving relief under the plan, they must do so by August 30. It also remains to be seen if any lawsuits challenging the program will be filed once the rules are finalized, and how those could play out.

Big Number

More than 30 million. That’s the total number of borrowers who could receive debt relief if the new plan takes effect, according to the Biden administration, up from 4.8 million that have already received relief through the administration’s efforts.

Tangent

The Biden administration’s new plans for loan forgiveness come as a separate student debt relief effort, the Saving on a Valuable Education (SAVE) repayment plan, is under fire in court, as GOP-led states have sued to overturn it. The Supreme Court is set to soon weigh in on select provisions of the plan, and a lower federal court separately blocked the plan earlier this month. The litigation remains ongoing, and it’s still unclear what the court battles will mean for borrowers.

Key Background

The Biden administration has made relieving student debt a key part of its work as student loan forgiveness has become a growing issue on the left. While President Joe Biden hasn’t gone as far as other Democrats who have pushed for forgiving student loans entirely, his administration initially announced sweeping relief with a plan to forgive up to $20,000 for all federal borrowers who make up to $125,000 a year. Before any debt relief could be disbursed, however, the program got tied up in the courts, and the Supreme Court ultimately struck down the program in June 2023, ruling the administration had overstepped its authority by imposing it. With that program off the table, the Biden administration has instead focused on taking a more piecemeal approach to student loan forgiveness, authorizing debt relief for only certain subsets of borrowers. Through those efforts, it has so far provided more than $168 million in relief, the Education Department said Wednesday.

Further Reading