A finance guru tore into a woman about her and her partner’s spending habits despite them earning a combined income of $11,500 a month.

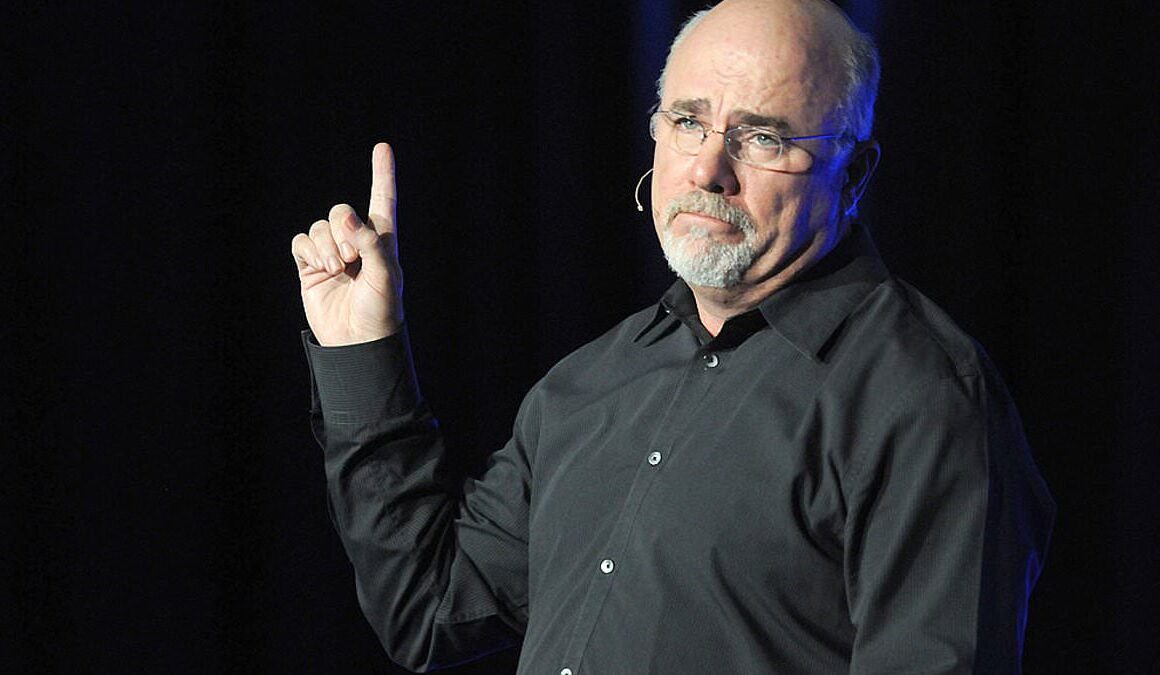

David Ramsey, an American radio personality known for his ultra-frugal advice, spoke to a woman called Alyssa who explained she and her husband do not contribute to their retirement and have just $3,000 in savings. They are also in debt to the tune of $138,000.

Alyssa explained on The Ramsey Show that they were living ‘paycheck to paycheck,’ but after diving deeper into their finances, Ramsey realized that wasn’t the case.

Ramsey asked if the couple, who make around $140,000 a year combined- much more than the average American- could set aside up to $5,000 every month to help pay off their shared $138,000 in debt.

Alyssa soon became wary of his advice, as Ramsey laid into her and said: ‘You know what I’m worried about? You make $130,000 a year and you’re freaking broke. That’s what I’m worried about.’

Financial guru David Ramsey gave a woman, Alyssa, the harsh reality about her finances after she told him she and her husband make a combined monthly income of $11,500

Ramsey immediately asked the woman how much debt she and her husband have together, as Alyssa reveals they owe $138,000.

Some $9,000 of that is from her schooling to become a mental health care therapist, while $40,000 is from her husband’s time in school.

The pair also owe an additional $60,000 on car payments and a mortgage with $240,000 left to pay off. So, in reality, the couple owe a total of $349,000.

Ramsey’s co-host, George Kamel, then chimed in and asked Alyssa how quickly she thinks they can pay their debt off, suggesting they start at $5,000 a month.

After hearing the hesitance in her voice, Kamel questioned Alyssa on what’s holding her back from getting rid of her debt.

She then explained that setting aside that money would make her worry about ensuring her nine-year-old daughter is secure.

Alyssa went on to say that she constantly worries about ‘catastrophic expenses’ because she is self-employed and her husband works in construction.

Ramsey got back to lecturing Alyssa after hearing her response.

‘You have a lifestyle that’s absolutely asinine, and that’s nothing to do with a nine-year-old,’ he added.

She responded by reiterating to him that she wants to have money left around in case of emergencies, but Ramsey didn’t buy her reasoning.

‘But you’re not doing anything about it. You got $3,000,’ he said.

Ramsey added that the money sitting in her savings account is just a ‘red herring’ that is doing nothing but ‘creating anxiety’ for Alyssa.

Alyssa explained that she and her husband have around $3,000 in savings and ‘live paycheck to paycheck,’ but after diving deeper into their finances, Ramsey quickly realized that wasn’t the case

‘You live like no one else so that later you can give and live like no one else,’ he added.

To help out the struggling couple, Ramsey crafted a detailed budget for them to follow that could see them quickly be able to set aside $50,000 a year to put toward their mound of debt.

Although it’s going to be hard for them to get used to, Ramsey insisted it’s something they have to do.

Ramsey, who started ‘from nothing’ had a net worth of a little more than $1million by the time he was 26, according to his website.

He and his wife lost ‘everything’ because of the debt they complied. Though they didn’t tell anyone about their struggles, Ramsey said it helped them get to where they are today.

‘I’ve paid the ‘stupid tax’ (mistakes with dollar signs on the end) so you don’t have to, and I’m here to tell you that whoever you are, wherever you came from, and however deep of a mess you might be in right now, you can get out of it.

‘You can take control and use the same commonsense principles I did to turn your situation around,’ Ramsey said on his website.