Earlier this week, we advised our premium subs that Goldman’s trading desk – whose derivatives guru Scott Rubner called the late July meltdown with uncanny precision literally on the day the market peaked – was getting increasingly cold feet, and went so far as to telegraph to clients how it would trade the crash if indeed a crash is coming.

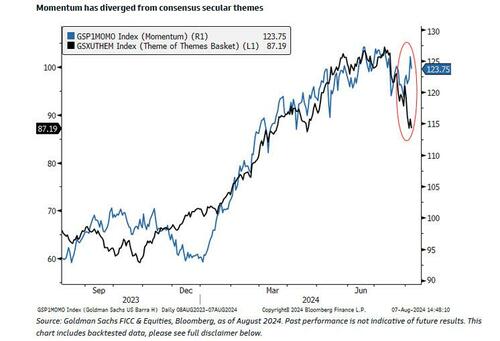

Specifically, Goldman thematic trader Louis Miller said that given the drawdown and uncertainty around AI, and uncertainty on 1. geopolitics, 2. US election, 3. US economy and 4. market microstructure, the bank “can say with confidence that today is different than yesterday and/or the recent past, and the momentum factor doesn’t really show that yet.” As such, the thematic desk recommended to sell this factor in this more discerning risk backdrop, especially as the moves in momentum have been muted in comparison to the index selloff and historical drawdowns of the factor