While inflation has brought car ownership costs to record highs in recent years, not every state provides the same financial burden to drive a vehicle.

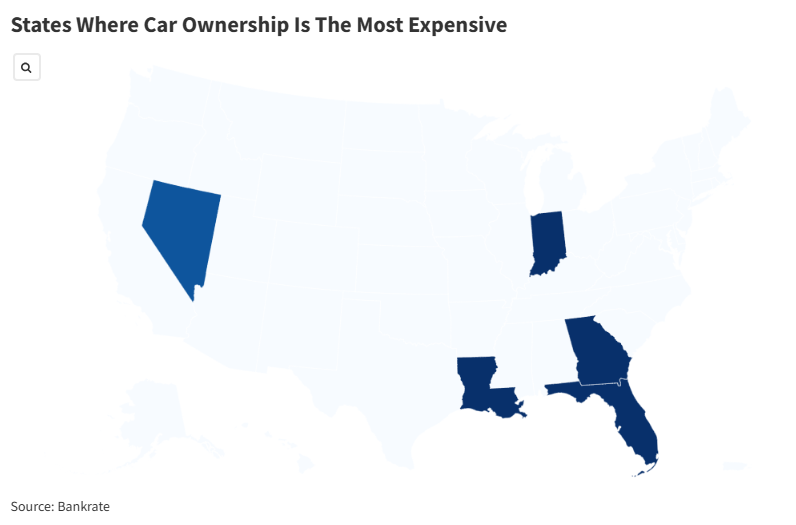

A few states topped the list when it came to overall car ownership costs in a new Bankrate report. This survey calculated each state’s car ownership costs, including full coverage car insurance, vehicle taxes, gas and maintenance and repair prices.

States in the South and West tended to have higher costs on average, but the worst five for auto owners were Georgia, Indiana, Louisiana, Florida and Nevada.

Those states saw average yearly costs of $8,249, $8,221, $8,220, $8,197 and $7,886 respectively. Meanwhile, New Hampshire, Washington, Alaska, Oregon and Delaware all saw some of the lowest car ownership costs, ranging roughly from $4,300 to $4,900 for one year.

“There are many hidden costs that few buyers consider when purchasing a new vehicle, but often not discussed as much as how some of these hidden costs are escalated by what state you live in,” Alex Beene, a financial literacy instructor for the University of Tennessee at Martin, told Newsweek.

“Some states on the list like California and New York aren’t shocking when you consider prices in general for all goods and services are higher in those locations, but other states that are generally viewed as cheaper may surprise in their higher rankings.”

Nationally, the average cost of car ownership is $6,684, which amounts to roughly $557 per month, plus whatever your car payment is, according to the study.

“We need to reframe our thinking about vehicle ownership and affordability,” Bankrate analyst Shannon Martin said in a statement. “A vehicle’s cost varies between drivers based on state-mandated coverage types, how much you drive, and even how the climate affects maintenance frequency. Instead of pricing insurance out as an afterthought, start with the car insurance budget first.”

Typically, Americans pay the most for car insurance, but gas costs can also eat up to $1,837 per year. Car repairs were an average of $1,336 yearly for Americans, and taxes made a dent of $1,182 on average as well.

Beene said the higher insurance in some states comes down to bad road conditions, dangerous weather and a higher average mileage if residents typically drive more.

“Ultimately, the sticker price doesn’t tell the full story, and potential buyers need to assess the full picture in their state before deciding to buy,” Beene said.

In Florida, one of the states with the highest costs, car owners routinely deal with natural disasters, and many of the insurance plans once available have left the state.

“The higher cost states have more mandated coverages such as PIP or personal injury protection which raises the overall cost of the insurance,” Kevin Thompson, a finance expert and the founder and CEO of 9i Capital Group, told Newsweek. “That’s in addition to gas, taxes, and normal maintenance which can indeed add up.”

Thompson said it will likely be impossible to get car ownership prices lower, especially due to the costs of replacements in vehicles today.

“Replacement costs will continue to increase as more and more technology is placed inside of the vehicle,” Thompson said. “Hundreds of sensors are in each vehicle, whether they are in seats, mirrors, or the AC unit. Unfortunately, the only way to minimize your cost of maintenance is to shop around when something goes wrong with your vehicle. Otherwise, we all need to prepare for higher costs until we can replace cars with robo-taxis across the country.”