Topline

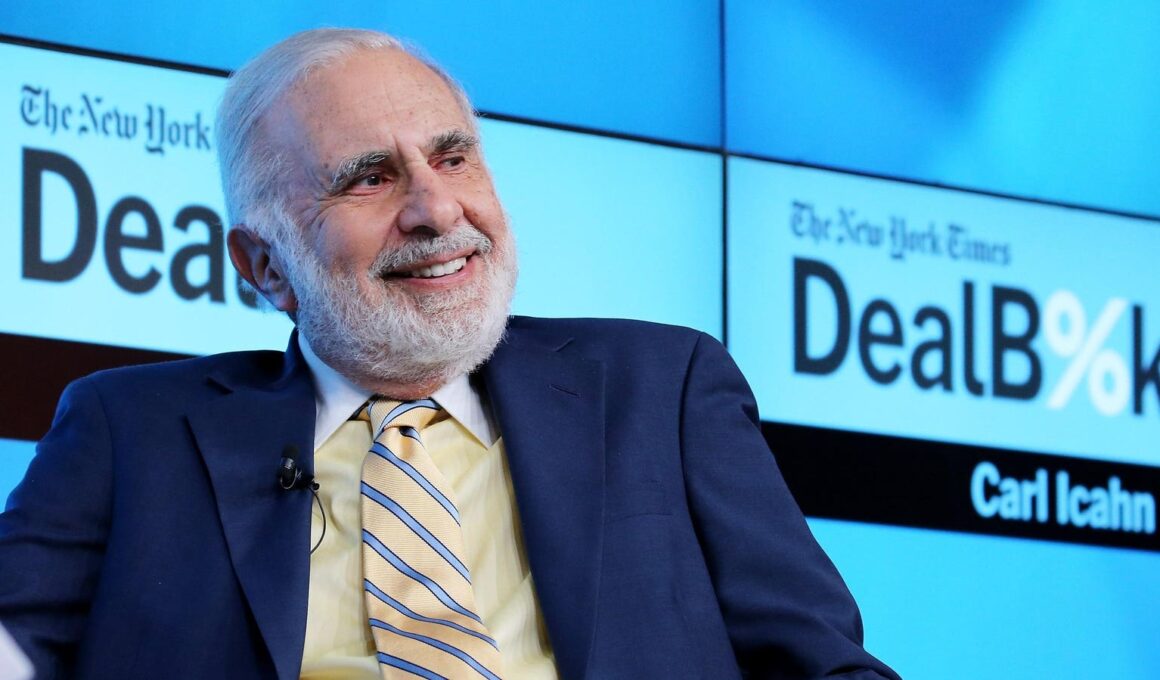

The Securities and Exchange Commission announced charges Monday against billionaire investor Carl Icahn and his holding company, Icahn Enterprises, after he allegedly failed to disclose information about stock pledges against the company to secure loans worth billions of dollars.

The billionaire and his holding company agreed to pay a combined $2 million to settle the claims.

Key Facts

Icahn and Icahn Enterprises agreed to pay $500,000 and $1.5 million, respectively, to settle the SEC’s charges, the agency said.

From 2018 to 2022, the SEC alleges Icahn, 88, pledged up to 65% of Icahn Enterprises’ outstanding securities as collateral to secure personal margin loans worth billions of dollars without disclosing to shareholders or federal regulators.

Icahn—Icahn Enterprises’ controlling shareholder—was required to disclose his pledges in a regulatory filing, which he did not do until July 2023, the SEC claims.

Icahn, who the SEC said cooperated fully in the agency’s investigation, said in a statement to Bloomberg he and his company were “glad to put this matter behind us” (a spokesperson for Icahn did not immediately respond to a request for comment from Forbes).

Shares of Icahn Enterprises fell over 5% shortly after trading opened on Monday morning.

Get Forbes Breaking News Text Alerts: We’re launching text message alerts so you’ll always know the biggest stories shaping the day’s headlines. Text “Alerts” to (201) 335-0739 or sign up here.

Forbes Valuation

Icahn has a net worth of about $5.2 billion, according to our latest estimates. A New York native, Icahn has been an investor on Wall Street for decades and operates Icahn Enterprises, a publicly traded firm that serves as Icahn’s primary investment vehicle. He also runs an investment fund made up of his personal cash and money belonging to Icahn Enterprises.

Key Background

Icahn explained to Bloomberg the SEC’s investigation started last year after famed short-selling firm Hindenburg Research claimed Icahn Enterprises artificially propped up its stock price through a “Ponzi-like economic structure.” Hindenburg alleged Icahn Enterprises traded at a higher premium because of “far-inflated” estimates on its investment returns, which enabled the company to pay out large dividends. Icahn noted Hindenburg’s allegations his company inflated asset values and operated in a “Ponzi-like structure” were not included in the SEC settlement. Icahn Enterprises—which reported assets of $14.6 billion in June—also denied Hindeburg’s claims, suggesting the firm’s report was “intended solely to generate profits” on Hindenburg’s short position on Icahn Enterprises. Icahn’s net worth has fallen nearly $10 billion since Hindenburg’s report, with shares of Icahn Enterprise dropping nearly 24% over the last year.

Further Reading