With high mortgage rates and soaring home prices, the dream of homeownership has escaped the reach of many Americans. That’s why it might come as a surprise that some of the poorest states across the nation have more homeowners than their more affluent counterparts.

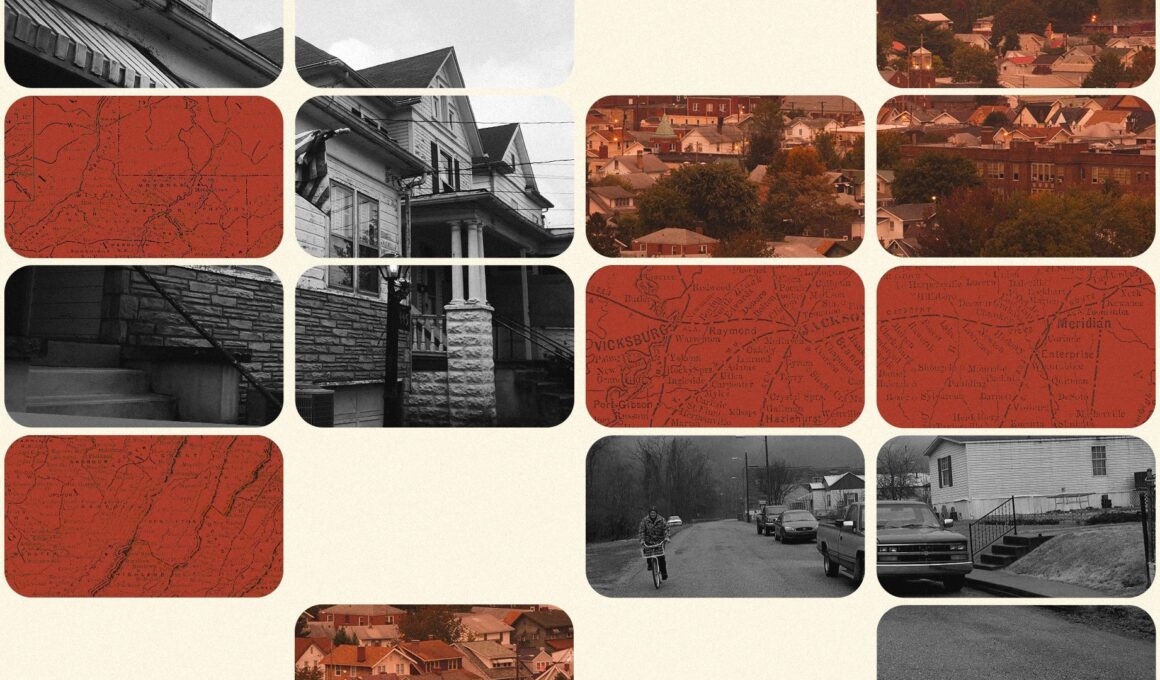

West Virginia leads all states with a 77% homeownership rate, followed closely by Delaware (75.7%), Mississippi (75.5%), Maine (75.5%), and Wyoming (74.5%), according to U.S. Census data.

Despite the high ownership percentages, these states—for the most part—have vastly lower average incomes compared with the rest of the country.

Wyoming is the exception (8th), though Mississippi and West Virginia have the first- and second-lowest average incomes in the nation, respectively. Delaware is ranked 24th and Maine 30th for personal income averages.

Other lower-income states with high ownership include Alabama (9th ownership, 48th income), South Carolina (12th ownership, 44th income), Idaho (15th ownership, 40th income), and New Mexico (18th ownership, 45th income).

(Andrew Lichtenstein/Corbis via Getty Images)

“A few factors are at play here,” says Realtor.com® economist Hannah Jones. “States with lower median income levels tend to have lower home prices as well, even when considered relative to earnings.”

States with the lowest homeownership rate include some of the nation’s highest-earning states: New York (6th income, 50th for ownership), California (4th income, 49th ownership), Nevada (25th income, 48th ownership), Hawaii (26th income, 47th ownership), and Massachusetts (1st income, 46th ownership).

“Though California, New York, and Massachusetts are among the highest-earning states in the U.S., buyers also see the highest home prices relative to income levels,” says Jones.

Home prices were between 8.8 and 9.8 times higher than the typical income level in these three states (using June 2024 median list price), compared with just 4.8 times higher in West Virginia.

“States with a primary, massive metro area—such as New York City and Boston—also see lower homeownership levels due to the large renter population in these highly populated metros,” Jones says.

Here’s a closer look at the states with the five highest—and lowest—rates of homeownership across America.

West Virginia

Homeownership rate: 77.0%

Average personal income: $52,585

(Realtor.com)

Delaware

Homeownership rate: 75.7%

Average personal income: $65,392

(Realtor.com)

Mississippi

Homeownership rate: 75.5%

Average personal income: $48,110

(Realtor.com)

Maine

Homeownership rate: 75.5%

Average personal income: $63,117

(Realtor.com)

Wyoming

Homeownership rate: 74.5%

Average personal income: $77,837

(Realtor.com)

New York

Homeownership rate: 53.3%

Average personal income: $79,581

(Realtor.com)

California

Homeownership rate: 55.8%

Average personal income: $80,423

(Realtor.com)

Nevada

Homeownership rate: 61.2%

Average personal income: $65,168

(Realtor.com)

Hawaii

Homeownership rate: 61.8%

Average personal income: $68,151

(Realtor.com)

Massachusetts

Homeownership rate: 61.9%

Average personal income: $87,812

(Realtor.com)