Topline

Starbucks announced a major shakeup to its top leadership team Tuesday, replacing its CEO with Chipotle’s top executive, as the coffee chain contends with multiple activist investor challenges during an extended stock market slump.

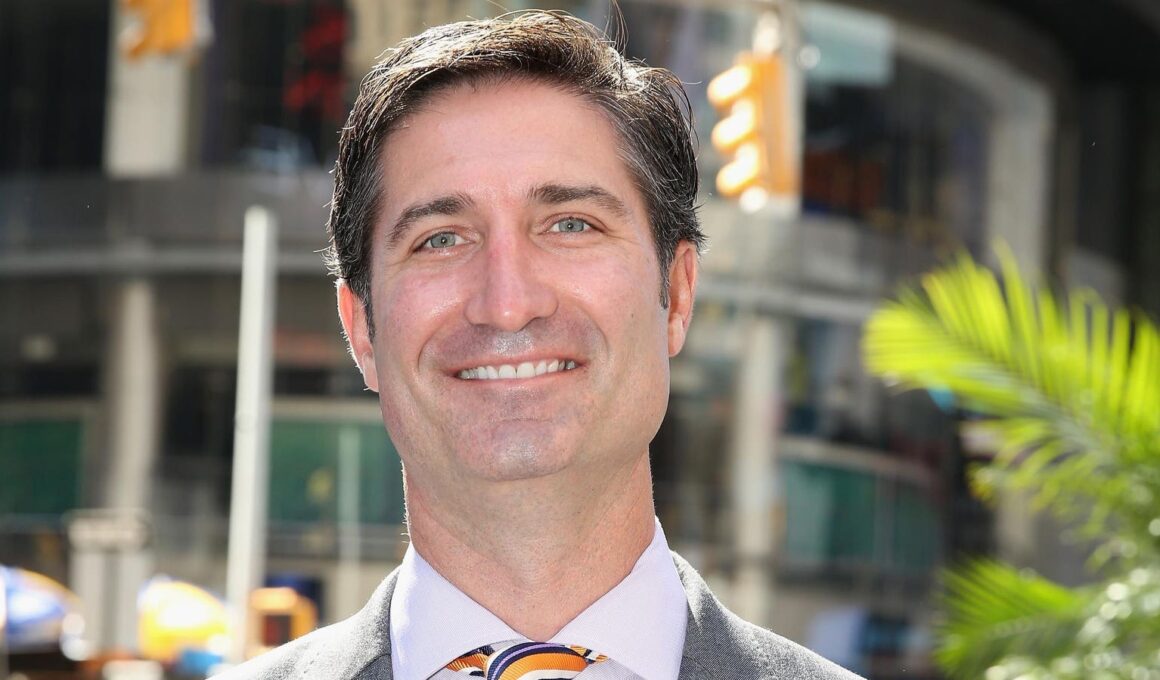

Brian Niccol, pictured in 2015, will be Starbucks’ top executive starting next month.

Key Facts

Starbucks said current chief executive Laxman Narasimhan resigned effective immediately, ending a 17-month tenure as CEO.

Burrito hawker Chipotle’s CEO Brian Niccol will step into the coffee chain’s same role Sept. 9, with Starbucks’ chief financial officer Rachel Ruggeri serving in the interim.

Shares of Starbucks shot up more than 20% at market open, while shares of Chipotle fell almost 9%.

Chipotle announced its chief operating officer Scott Boatwright will replace Niccol as interim CEO.

Surprising Fact

Starbucks stock’s more than 20% morning rise would be its best day since its 1992 initial public offering, according to FactSet data. Early trading can be highly volatile as investors digest news, but it’s a reflection of investors’ hope that Niccol can help turn the stock around.

Who Is Brian Niccol?

A 1996 graduate of Miami University of Ohio, Niccol has worked as Chipotle’s CEO since 2018, also serving as the company’s chairman of the board since 2020. Niccol was the chief executive of Taco Bell from 2015 to 2018, and serves on the board of directors at Walmart, the most valuable brick and mortar retailer in the world. Niccol’s tenure at Chipotle coincided with an explosion in its share price, gaining more than 1,000% since his Feb. 2018 appointment, adjusting for its recent split, as the company’s annual net profits increased sixfold.

Key Background

Starbucks is looking for a spark as its stock has significantly underperformed the S&P 500 on year-to-date, 5-year and 10-year bases, with shares trading Monday at about 20% below where they were in Aug. 2019. That came as Starbucks contended with significantly slowing sales growth—analysts expect the company to report less than 2% annual growth in its fiscal year ending next month—and, perhaps more crucially, an inability thus far to recapture pre-pandemic profits, with its $4 billion projected 2024 net income well below 2019’s record $4.5 billion. Notable activist firms like Elliot Investment Management and Starboard Value have recently taken sizable stakes in Starbucks to pressure the company to focus on increasing shareholder value.

Trump Media to the Saudi Arabian influence on golf and what real-life billionaires think of ” Succession.” Send tips to dsaul@forbes.com. Follow Saul for analysis on the biggest daily economic and stock market happenings, ranging from inflation data to tech earnings to deep-dives on hot button assets.

“>