If it has been a while since you last went to the cinema, you are not alone.

Over the past few years, Britain has been falling out of love with the silver screen as Hollywood strikes, rising prices and the popularity of TV streamers have all turned audiences off.

Industry experts credit the ‘unique challenges of the pandemic’ as the beginning of the recent problems, but even once lockdown was lifted the once-promised mass return of crowds to theatres failed to materialise.

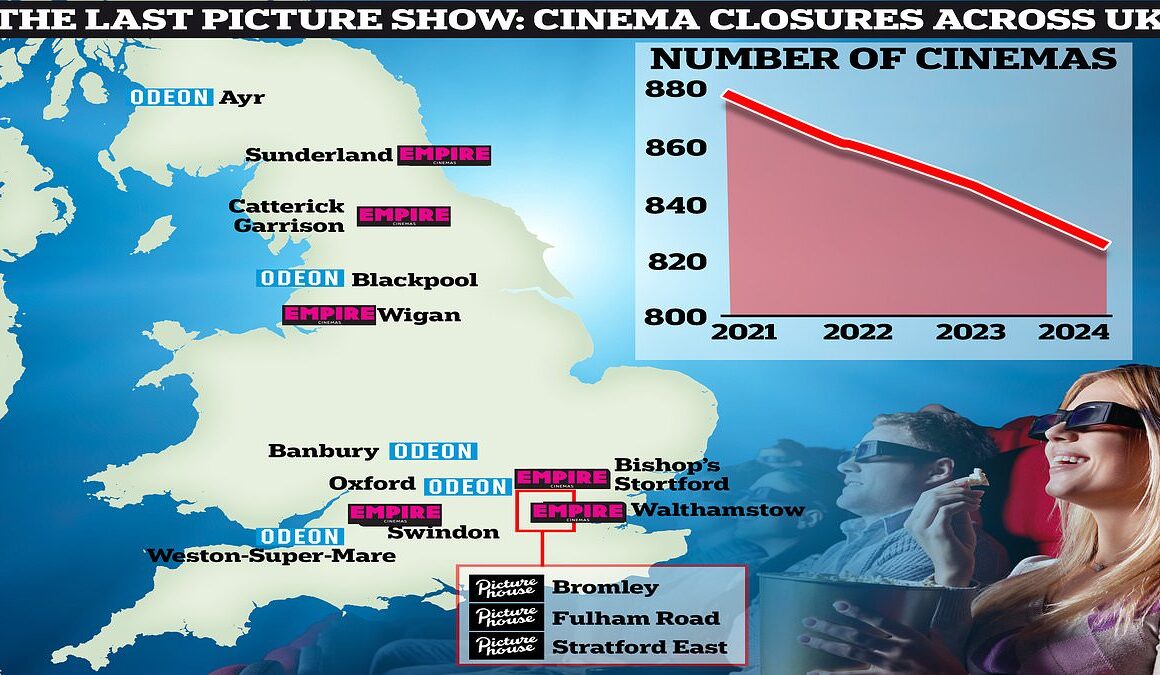

In 2020 there were 879 cinemas in the UK, but it has fallen every year since then and now amounts to only 825, according to the UK Cinema Association.

And the storm clouds over the industry continued to darken after it was revealed Cineworld, which currently runs around 100 sites across the country, is expected to publish plans to close 25 of them as part of its restructuring.

But Cineworld is not alone in facing headwinds, with brands such as Picturehouse, Odeon and Empire all also having to close cinemas in the past year.

Now MailOnline has mapped out where these closures are taking place, revealing a shrinking industry in crisis.

A map of the Empire, Odeon and Picturehouse cinemas which have closed in the past year. The top right chart shows the number of cinemas has dropped from 879 in 2020 to now only 825

And the storm clouds over the industry continued to darken after it was revealed Cineworld, which currently runs around 100 sites across the country, is expected to close 25 as part of a restructuring plan

Picturehouse will close branches at Stratford East, Bromley and Fulham Road in London this summer.

Meanwhile Odeon closed five in June last year, with Empire collapsing into administration a month later – closing six.

It is not yet known where Cineworld’s closures will be located, with a spokeswoman only commenting: ‘We continue to review our options but we don’t comment on rumours and speculation.’

And it is not just chain cinemas under pressure. A survey by the Independent Cinema Office in October found 45 per cent of independent cinemas were operating at a loss by the end of 2023/24.

The chief executive of the UK Cinema Association Phil Clapp told MailOnline the operating environment for UK cinema ‘undoubtedly remains a challenging one’.

He said: ‘Having survived the unique challenges of the pandemic – when many sites were closed or operating under restrictions for many months – the sector has since then needed to navigate both the cost of living crisis and the writers’ and actors’ strikes of last Autumn.

‘The latter in particular has meant that cinemas have had many fewer films to show the public than they would want.’

The chief executive of the UK Cinema Association Phil Clapp told MailOnline the operating environment for UK cinema ‘undoubtedly remains a challenging one’

Cineworld faced problems of people not returning to the cinema post-pandemic and instead increasingly choosing to stay at home and watch new releases on streaming services. Pictured: A boarded up Cineworld cinema in London during the pandemic

One trip to the cinema for a family can cost more than an entire year’s subscription to a streaming service

But Mr Clapp remains upbeat about the future, claiming although ‘no one underestimates the road ahead’ there have been signs of strength with examples such as Barbenheimer and Disney animation Inside Out 2.

In the coming months Despicable Me 4, Deadpool and Wolverine, and Paddington in Peru are also a source of optimism for the sector.

However a recurring problem facing cinemas in the increasingly short period of time they have to exclusively show films before they appear on DVD and streaming platforms.

Known as the theatrical ‘window’, the timeline has become one of the biggest ongoing debates in the cinema industry.

It used to stand at a fairly standard 12 weeks in the US and 16 weeks elsewhere, but with the rise of streaming platforms the window has been getting shorter, with some blockbuster films missing out cinemas entirely.

The trend became especially noticeable when Martin Scorsese’s epic gangster film The Irishman was streamed on Netflix after only four weeks at the cinema in 2019.

The theatrical window was so short most UK cinema chains turned down the film and never showed it in theatres at all.

The practice became so embedded that Scarlett Johansson sued Disney after her Marvel film Black Widow was released on Disney+ and Cinemas on the same day in 2021.

Johansson claimed because her pay was linked to the film’s box-office performance, the decision to stream it instantly hit her wallet. Disney and Johansson eventually settled the lawsuit for a reported £29.7m.

However MailOnline revealed this month that customers claim it is not the quantity of films but the price which is stopping them from going to the cinema.

MailOnline calculated that a family of four trip to Cineworld could cost more than £100.

That’s for a family of four to see a 4DX screening of Inside Out 2 at Wandsworth in London, two large popcorns, two large hot dogs, confectionary for the two children and four large soft drinks.

Cineworld customers have said the chain has priced them out of trips to the movies. Pictured: Cineworld prices

Cineworld grew under the leadership of the Greidinger family into a global giant of the film industry, acquiring chains including Regal in the US in 2018. Pictured: A view of the Regal movie theater while it was closed due to Covid in March 2021 in Times Square, New York

Fulham Road Picturehouse will be closing its doors on July 11

Bromley Picturehouse will also be closing its doors on August 1. One customer called it a ‘sad state of affairs’

Cineworld disputed MailOnline’s figures and claimed a Family Special deal would be cheaper, although this would take customer research and would not be available for everyone.

And the price problem for cinemas is made worse by the comparably good value offered by streaming services.

One trip to the cinema for a family can cost more than an entire year’s subscription to one – and they include a catalogue of hundreds of films and TV shows to be watched as many times as customers want.

Amazon Prime video costs £5.99 a month or £79 for the whole year for an Amazon Prime subscription which includes free delivery.

Netflix costs £10.99 a month for two devices on HD quality, Disney+ is priced at £7.99 a month or £79.90 for a year, whereas Apple TV+ costs £4.99 a month.

The soaring prices are in part due to the pricey popcorn and drinks, which can quickly double the cost of a ticket.

The rising prices of the cinema and the ready availability of streaming services means admissions have been slowing in recent years.

UK cinema-going peaked immediately after the Second World War, with a record 1.63 billion cinema admissions in 1946.

But the numbers have been falling dramatically, with only 289 million admissions 20 years later and an all-time low of 54 million in 1984.

Going to the movies then started to become more popular again and in the mid 2010s about 165 million tickets were sold in UK cinemas each year.

Empire Cinemas was forced to close six of its UK locations after entering into administration in July

Empire is one of many chains in the UK which has been forced to close locations in the past year

Smaller chains like Everyman and Curzon have entered the market and are using more unusual models where they appear more like a live theatre or opera.

If the 25 Cineworld sites predicted to close do indeed get shut down, there is likely to be a scramble among other operators to acquire them.

Tim Richards, chief executive of cinema chain Vue, said previously he would ‘absolutely’ look to take over sites from rival operators.

He said: ‘They would need to be qualitatively complimentary with our circuit but I think we’ve already demonstrated over the last 20 years that M&A and purchasing cinemas is part of our DNA.’

But market conditions are still tough for all operators. Mr Richards told the BBC’s Wake up to Money programme there were 35 per cent fewer films released in 2022 than in the pre-pandemic era and 20 per cent fewer in 2023.

He compared this with the period between 2017 and 2019 when there were three consecutive box office world records set.

Tim Richards, chief executive of cinema chain Vue, said he would ‘absolutely’ look to take over sites from rival operators

One stark example for the pressures facing the UK cinema industry has been the continued struggles of Cineworld over the past few years

What has been happening to Cineworld?

One stark example for the pressures facing the UK cinema industry has been the continued struggles of Cineworld over the past few years.

Earlier this week sources told Sky News that the insolvency mechanism employed by Cineworld was expected to be a restructuring plan which would allow it to rework its balance sheet and restructure debts.

Cineworld grew under the leadership of the Greidinger family into a global giant of the film industry, acquiring chains including Regal in the US in 2018 and the British company of the same name four years prior.

However its multibillion-dollar debt mountain led it into crisis, and forced the company into Chapter 11 bankruptcy protection in the U.S. in 2022.

Filing for a Chapter 11 bankruptcy means a company intends to reorganise its debts and assets to have a fresh start, while remaining in business.

Cineworld shares were worth just 0.6p in June last year after it was hit hard by the pandemic. They were changing hands at 300p just five years ago.

It caused it to delist from the London Stock Exchange in August 2023 after Cineworld’s UK arm collapsed into administration as its share price continued to fall and fears were raised for its survival.

A deal was struck last year which exchanged several billions of dollars of debt for shares, with a significant sum of fresh cash injected into the company by a group of hedge funds and investors.