BRANSON, Mo. — The search for the mysterious company behind a scheme to steal Elvis Presley’s Graceland estate led last week to a small, quiet city near the Ozark Mountains and the gnome-lined porch of a trailer, nestled along one branch of a winding lake.

The path there was just as circuitous, stretching across decades and state lines, traced through internet profiles, criminal backgrounds, family histories, legal records and old memories.

It began with a brazen plot that made international headlines in May: Naussany Investments, a company that did not seem to exist, run by people who did not seem to exist, had filed a claim seeking control of Graceland over what they alleged was an unpaid debt. Naussany Investments said Lisa Marie Presley, Elvis’ only child, owed them millions of dollars in unpaid loans when she died a year earlier, and after failing to collect from the estate, the company would force the foreclosure sale of the historic Memphis, Tennessee, mansion as repayment.

The documents filed to support Naussany Investments’ case were clearly forged, and within days of the foreclosure sale being halted by a judge, the scammers admitted their plot.

After posing as “Kurt Naussany,” “Gregory Naussany” and “Carolyn Williams,” executives for the fictional Naussany Investments company, the scammers wrote to NBC News and other outlets that they were dropping the charade. Emails from a person calling himself Gregory Naussany said he was part of a ring of Nigerian identity thieves and boasted that even with the Graceland failure they would keep preying on people without fear of capture. “We sit back and laugh at you idiots and watch you make fools of yourselves,” read the email, written in clunky Spanish. “Come find us in Nigeria.”

That confession seemed to be the final act in a legal drama that was now a matter for the authorities, including the attorney general of Tennessee, whose office announced it was investigating Naussany Investments.

But it was not the end of the story. The forged loan documents and legal filings in the foreclosure case contained a number of clues that led not to a gang of scammers in West Africa, but to a city five hours northwest of Graceland, where a convoluted dispute playing out on Facebook and in local courts bore surprising connections to the Naussany case.

,

,

,

,

These connections led to a grandmother in Branson, Missouri, a con woman with a decadeslong rap sheet of romance scams, forged checks and bank fraud totaling hundreds of thousands of dollars, for which she did time in state and federal prison.

She goes by Lisa Holden these days, but former friends, family and victims know her by other last names, including Howell, Findley and Sullins. NBC News found Lisa through Facebook and Google, where she appeared to use the name Naussany to post negative reviews for people and businesses she didn’t like, and positive reviews for those she did. More than half a dozen links seemed to separately connect Lisa with the foiled attempt at Graceland, including phone and fax numbers, post office boxes and fake personas.

Those who know Lisa know her as different people: a woman made wealthy from inheritance, a cannabis entrepreneur, an underwater welder, an online harasser, a cancer faker, and a scammer. One thing they seem to agree on: She’s determined.

“Oh, she does not quit,” said Paula O’Dell, who knew Lisa as a flight medic and successfully sued her in 2007 for the return of $6,000 Lisa had borrowed under false pretenses. As a reporter was leaving a message on her answering machine, O’Dell picked up.

“When I heard that name, I thought ‘Oh, no,’” O’Dell said. “What’s she done now?”

,

,

,

,

Near the end of last summer, Kurt Naussany, an executive for Naussany Investments & Private Lending LLC, began emailing the estate of Lisa Marie Presley to demand payment on a $3.8 million loan she had supposedly taken out in 2018, putting up Graceland as collateral.

The documents used as evidence of the debt, which included Presley’s signature and a notary’s, had been forged, according to the estate’s lawyers, who filed a legal complaint against Naussany Investments and Kurt Naussany to stop Graceland’s foreclosure sale, which had been scheduled for May 23.

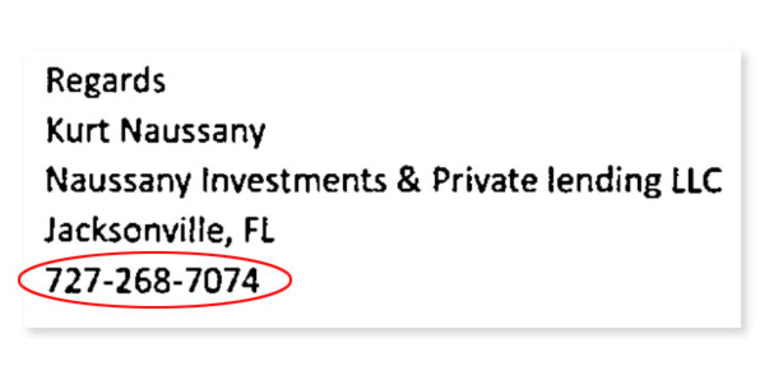

What became quickly clear: Kurt Naussany did not exist. And Naussany, as a name, also did not seem to exist. There was no record of it in any of the numerous public records databases used by NBC News, nor in business or court filings. The only other name associated with the attempted sale of Graceland was too common to track down: Carolyn Williams, listed as Naussany’s “senior collection officer” in the forged loan documents.

But while Kurt and Carolyn may not have existed in the real world, they lived online.

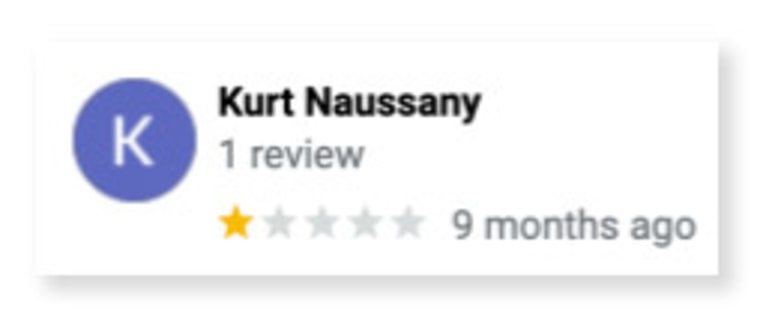

In September, a Kurt Naussany claiming to be “a Law Enforcement Investigator” left a negative Google review at a Tulsa, Oklahoma, car dealership, warning others to “BEWARE OF THERE FRAUD!!”

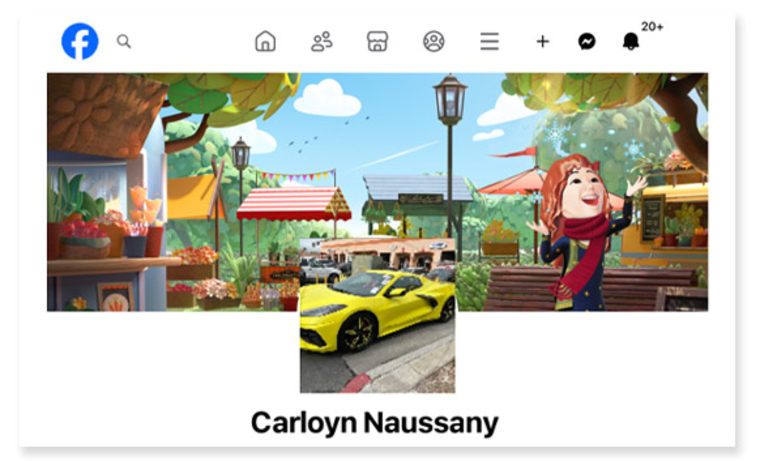

And a new Facebook profile was created for “Carloyn Naussany,” an apparent misspelling of “Carolyn,” described as a self-employed entrepreneur in Branson. The account would be used as a weapon in a battle between a local nail salon and a disgruntled former employee whom Lisa had befriended.

The account’s first post was a negative review of the nail salon in the town’s dirty laundry Facebook group, Branson Buzz: “This should tell you enough about NV NAILS BRANSON LANDING. A shame a young girl had to lose fingertips because of carelessness. Wonder if the salon is facing a lawsuit.?!” Carloyn Naussany’s review of NV Nails included screenshots of a review from a mother in Las Vegas alleging her daughter’s fingertips had to be surgically removed because of the manicure she got on vacation in Branson. Screenshots of other reviews posted to Google came from names including “WelderGirl” and “None Ya.”

More bad Google and Facebook reviews for the salon followed under different names, few of which appeared tied to real people. The reviews were littered with misspellings and used a similar style of nonstandard grammar, capitalization and punctuation. They included personal insults and accusations about the owners, threats of legal action and tales of dissatisfaction.

The owners of NV Nails were friends. They had bought the business less than a year before from the longtime owner, who was looking to retire. And as offbeat as Branson could be — it’s known for its Elvis tribute artists and extended-stay motels, like Vegas, but for Christians — they couldn’t have guessed what they were in for.

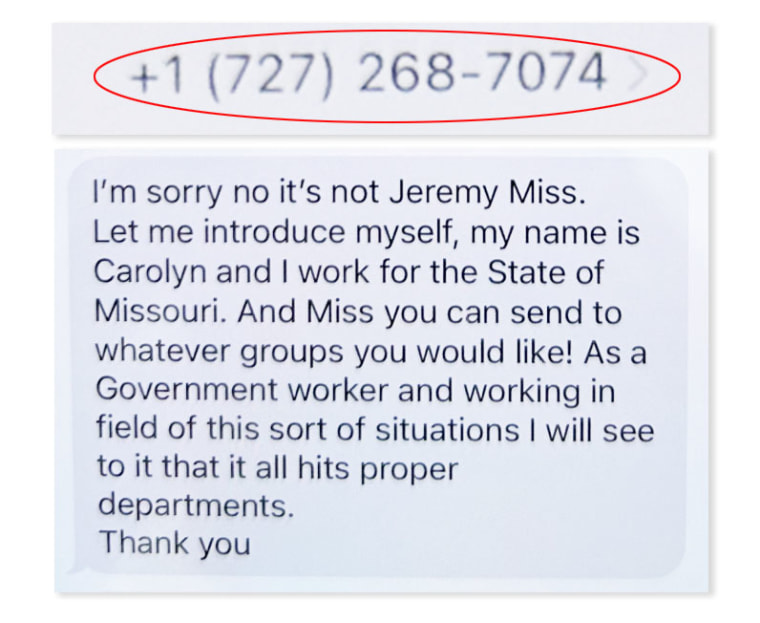

Along with the seemingly fake reviews, they began receiving texts from someone claiming to be “Carolyn,” a Missouri state investigator who didn’t give a last name. In the texts, Carolyn threatened legal action on behalf of a former salon employee, Rasheed Jeremy Carballo.

The texts would become evidence in legal cases that the salon’s owners brought in Missouri’s Taney County last September seeking orders of protection against Carballo. They claimed he was behind a bizarre harassment campaign that included spamming their business with negative fake reviews and constant texts and emails from the “investigator” named Carolyn.

In the request for an order of protection, salon owner Karen Virtudazo wrote she was “continually sent emails, texts, phone calls posing as law enforcement, attorneys, the Missouri attorney general, Secretary of state investigator and the U.S. Marshall.” She wrote that one attorney, who she later learned to be fake, said she was being sued for $1 million and asked for her Social Security number to protect her. Virtudazo gave it. She soon began receiving credit alerts showing that someone was applying for loans in her name, she alleged in a police report.

,

,

,

,

“It was scary,” Virtudazo recalled in a recent interview at her attorney’s office. And it was coming at a particularly hard time; her mother had just died in the Philippines. “I was very stressed at the time. I didn’t know what was going on. So when someone calls me being a U.S. Marshal, I panic; when someone calls me being a state representative, I panic.”

The other salon owner was being targeted, too. A Google account with the name Kurt Naussany, claiming to be from the “Government Investigation Dept” of FDIC, posted a negative review for the bank where she worked, claiming she had committed embezzlement and fraud.

A recent immigrant from Belize, Carballo had found work doing nails in the salon. It would be a brief gig and an acrimonious split with the owners, following an August 2023 incident in which the police responded to an argument between Carballo and a customer over the quality of his work.

Carballo didn’t know many people in Branson. One of his earliest friends was a woman named Lisa whom he’d met at a local Starbucks where he was working as a barista. In phone interviews with NBC News, Carballo said Lisa told him that an inheritance had made her rich and that she was getting into the weed dispensary business. Lisa offered him a room in her home, and after the falling out with the salon owners, the promise of support. That support, he said, was moral at first, but expanded to include the harassment campaign and eventually the promise of legal help. In court filings and in an interview with NBC News, Carballo insisted he wasn’t a part of any harassment.

“She was terrorizing these people,” Carballo said of Lisa’s constant emails, texts and reviews.

Lisa, who had also been a customer of the salon, reached out to Virtudazo in September, according to an email obtained by NBC News. Sent from Lisa’s email address, it forwarded an email sharing details of an impending lawsuit and investigation into the nail salon on behalf of the Las Vegas mother from the Google review. The forwarded letter included a PDF of a consumer complaint lodged with the Missouri attorney general and was signed by Carolyn Williams, of Jefferson City, Missouri’s “Investigations Dept,” which does not exist.

“Not good,” Lisa’s email read. “That business is in serious trouble.”

Carolyn Williams was also the name of the representative who filed the claim in January on behalf of Naussany Investments in the scheme to force the sale of Graceland.

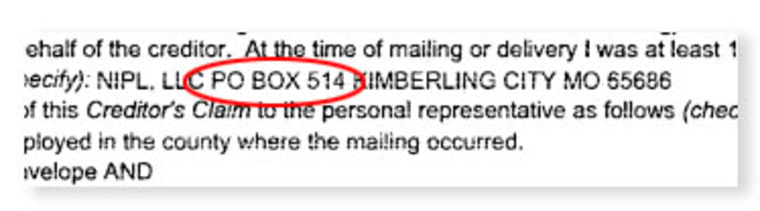

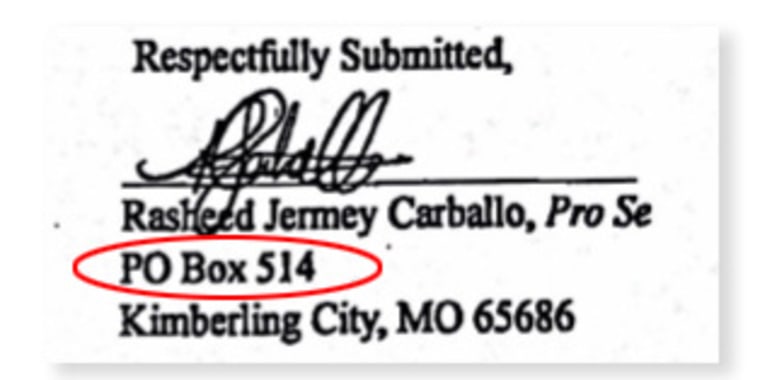

Carballo said that Lisa first offered to pay for a lawyer to fight the orders of protection sought by the salon owners, but instead, she ended up helping him file responses in court and accompanied him to a hearing. In January, Carballo filed a request to dismiss Virtudazo’s protective order case. The filing lists his address as P.O. Box 514, Kimberling City, MO, an address Carballo said Lisa provided.

The same month, Carolyn Williams, representing Naussany Investments, filed a creditor’s claim against Lisa Marie Presley’s estate in Los Angeles County, listing Naussany’s address as the same place: P.O. Box 514 in Kimberling City.

There were other connections to the Graceland scam, too:

One: In February, Carballo submitted a handwritten letter to the court in the protection order case. The letter was sent via fax from 1-877-361-0412; Carballo said Lisa faxed it on his behalf. In May, someone calling himself Gregory E. Nassauny used the same number to fax a motion in Shelby County Chancery Court in Tennessee seeking to prevent the Presley estate from stopping the foreclosure sale of Graceland.

Two: The texts sent to the salon owners from Carolyn, who claimed to be a Missouri state investigator, came from 727-268-7074, the same number listed on documents in September attached to the fraudulent creditor’s claim for Presley’s loan in Los Angeles County court. In that filing, the Naussany company included a copy of an email in which Kurt Naussany seeks records from U.S. Bank. His email signature includes the 7074 number.

And three: Naussany’s other listed address, P.O. Box 1015 in Hollister, Missouri, is associated with the name and email address Lisa is currently using, according to public records databases.

Carballo told NBC News he didn’t recognize the name Graceland, but Lisa Marie Presley sounded familiar. Carballo lived with his friend Lisa for about five months. Early in 2024, she talked with Carballo about a foreclosure deal and Lisa Marie Presley’s house and how she and a California lawyer were going to get a couple of million dollars, he said. After being interviewed by NBC News, Carballo said he went to the FBI with what he knew. An FBI spokesperson said the agency does not comment on investigations, including the possibility or likelihood of one.

Carballo left Branson in February, moving to Illinois to be near family and more opportunity, he said. Meanwhile, Naussany’s attempt at a Graceland foreclosure continued. And on Facebook, the Carloyn Naussany account (whose profile photo of a car outside a repair shop NBC News traced to a California town where Lisa previously lived) fired up again — this time offering an even clearer link to Lisa.

,

,

,

,

In March, Carloyn Naussany posted to Facebook a call for people in Branson West and Kimberling City to come to the King Food Saver grocery store for photos with the Easter Bunny. The posts included photos of an adult dressed as the Easter Bunny and baskets for sale. Later, Lisa posted the same photos to the Branson Buzz Facebook group from her personal account and included her phone number.

Reached by phone, Lisa’s live-in partner Maria Tazbaz said she sold the Easter baskets at her hardware store. “I don’t know who Carolyn is, but those are my Easter baskets,” Tazbaz said. On Google, Tazbaz’s store, Mr Riobe Discount Tools and More, received a glowing Google Review from “WelderGirl46.”

Welder Girl’s only previous reviews were for NV nail salon, and Oakley Auto World, which included a photo of Lisa posing beside a salesman and her new silver Chrysler. The same car was parked outside Lisa’s Kimberling City home last week, a trailer park community on the edge of Table Rock Lake where she lives with Tazbaz and her sister, Linda. It’s just a four-minute drive from P.O. Box 514, where Naussany Investments is supposedly based.

“Do you remember when the movie came out, ‘Catch Me If You Can’?” Lisa’s ex-husband Steven Sullins asked last week in a phone interview with NBC News, recalling the 2002 Leonardo DiCaprio film about a professional forger and conman. “That’s her. That’s what she does.”

Sullins and Lisa divorced in 2002 after about eight years of marriage. After the divorce, Sullins said he would hear news that Lisa had been arrested for bad checks and fraud. Sometimes he said victims would contact him and tell him stories. Sullins said Lisa had been certified as a nursing assistant (Oklahoma State Department of Health records do include a 1992 long-term-care aide certification for a Lisa Sullins), but she was passing herself off as other things: an EMT, a hairdresser and an underwater welder.

“She walked into a bar one night and had a doctor’s coat on, had like three pagers on her, two cellphones, and she’d be like, ‘Oh, I need to go outside and take a call,’” Sullins said. “But I turned around and looked at people and was like, ‘She ain’t no damn doctor.’”

Lisa and Sullins had one child together, a boy also named Steve, who lived with his dad. Lisa wasn’t a reliable parent, her son said in a phone interview, but they keep in touch. Last summer, he said Lisa traded in her car and bought him a truck from South Pointe Chrysler Jeep Dodge Ram in Tulsa. Shortly afterward, Kurt Naussany left a review for the same dealership alleging that the business accepted trade-in cars that had been stolen.

Steve said the truck was Lisa making good on an old offer to “take care of him,” a promise that had been made and delayed for years. He said Lisa talked about having a trust, with the money coming from a marriage six or seven years ago to a Kurt Howell in Las Vegas, who owned a pipeline company, and for whom she worked as a welder. Public records databases don’t show any records for him in Nevada, and there are no records of marriages for either Lisa or Kurt Howell in Clark County.

“I’ve never seen the guy. I’ve never met him,” Steve said of Howell. “I have no idea who he is, where he’s from, if he’s even real, or if any of this trust is real or anything like that.”

Lisa was born in California in 1971 and moved with her family to Cleveland, Oklahoma, when she was around 6. She was the middle child of three; her older sister would describe their upbringing in a court filing as “dysfunctional.” Her parents owned a bail bonds business for which her dad, a Vietnam vet, was a bounty hunter; he also worked as a correctional officer at a state prison in Osage County. Her mother died at 44 from a brain aneurysm.

Lisa’s first reported brush with the law was in 1997, when she was 26 and arrested in Sapulpa, Oklahoma, for writing a bogus check. For the next 20 years Lisa would be in and out of jails, courts and prisons, charged with various crimes, including stealing checks and credit cards, committing fraud, running con games, intimidating witnesses and obstructing investigations. Her cases took years to wind through the courts, in part because she was often tangled up in other cases or incarcerated in other jurisdictions. But in 2005, she was hit with federal charges. Prosecutors claimed she used fake Social Security numbers to obtain more than $180,000 in loans from Tulsa banks. Lisa pleaded guilty to one count of making a false statement in an application for a loan and was sentenced to 20 months and restitution.

By 2009 Lisa was on supervised parole, but couldn’t stop committing crimes, according to her parole officer, who asked a judge to consider putting her back in prison. In a letter to the judge, the parole officer outlined Lisa’s infractions: She faked cancer to get sympathy from a court on a charge for bogus checks. She stole a check while working as a cashier at a Sand Springs KMart, admitting the theft when confronted by store security. And on a trip to Springfield, Missouri, Lisa stayed in a business king suite at the Ramada Oasis Convention Center and left without paying for her room. During the stay, Lisa posed as an employee planning a convention for KMart’s parent company, reserving 48 guest rooms as “part of a scheme to defraud the hotel,” the parole officer said.

After spending much of 2010 and 2011 imprisoned in Oklahoma, Lisa was released. Over the next three years, she moved 11 times, mostly following a trail of lovers whom she met on internet dating sites and repeatedly scammed, according to her probation officer’s report. One man was out thousands of dollars after Lisa convinced him to loan her money to unlock a gold inheritance. At a hearing for the revocation of her release, the parole officer testified she had “noticed, and attempted to stop, a pattern by the defendant of defrauding her boyfriends.” A judge locked her back up.

,

,

,

,

Around the same time, Lisa’s sister, Linda, two years older, who also goes by a variety of aliases, was dealing with legal troubles of her own, stemming from an early-aughts investment scam that netted millions.

Linda’s crimes were more sophisticated than Lisa’s bad checks and romance scams. According to the government’s case, from around 2006, Linda had been luring victims into investing in a fake hedge fund called RGM Enterprises LLC with promises of 40% returns. (One victim said he was later told by authorities it stood for “Really Great Money.”) The company came with a Las Vegas phone number and a fancy Las Vegas office address but in reality, was being run through a post office box. Promotional materials boasted a large staff, including a Cornell-educated chief operating officer, Joshua Nichols. After the FBI failed to find any record of him, the U.S. magistrate judge in the case wrote, “it is questionable whether Joshua Nichols is an actual person.”

Instead of investing the money she got, prosecutors said Linda spent it: $62,000 on travel, $25,000 on tickets to the Grammys, $15,000 on furniture — all the while sending victims falsified balance sheets showing huge gains. A survey of her assets also found a house, cars, jewelry, a painting and marble statues. When investors started suing her for their returns, she used a $5 million investment from her biggest fish, a recent lottery winner in Maryland, to pay them off, turning the outright scam into a kind of Ponzi scheme. The FBI was knocking on her door in 2010 and she was indicted that December.

Linda’s trial was delayed for years. Two of her attorneys quit because Linda failed to pay them or wrote bad checks to cover their bills, according to court filings. Linda also put in several requests for continuances due to bad health, at different times claiming she had leukemia, thyroid cancer, lupus, lung cancer, anemia, pneumonia, difficulty eating, a mouth infection, severe headaches, a swollen throat, vomiting, no voice and a cough, among other ailments. An independent doctor brought at the request of the government found no record or evidence of leukemia or any other serious illness.

Linda pleaded guilty to wire fraud and tax fraud and was sentenced to 45 months in prison and three years of supervised release. Her husband at the time, an accountant named Bill Livolsi, was sentenced to 24 months for his role in moving her ill-gotten gains. He is now the deputy director of Progressive Prison Ministries and mentors other white-collar criminals.

After her release in 2019, Linda got a job managing an apartment complex in Tulsa. The current property owner told NBC News that Linda was fired after items in the furnished apartments went missing and the books were off.

Meanwhile, Lisa was moving around. From Oklahoma to Las Vegas to California and finally, in 2023, to Missouri. She rented a house in Branson with the story that she was a millionaire and needed a rental while she decided what she wanted to buy. She showed the property manager bank statements to prove her wealth, according to the landlord, Andrew Passey, who she later sued for damages to her property from a basement flood. She dropped the lawsuit after Passey filed a counterclaim for attorney fees.

Lisa and Linda started living together again last year.

There are echoes of Linda’s fake investment company’s Ponzi scheme in the Graceland scam, but no evidence tying her to the Naussany foreclosure caper. Linda, who did not return several requests for interviews, sleeps most of the day, according to her former housemate, Carballo, and at night stays mostly in her room, “always, always on the laptop.”

It’s puzzling to consider how Lisa might have graduated from small-time hustling of boyfriends and big-box stores to an attempt at multimillion-dollar fraud and the theft of one of the country’s most beloved landmarks.

One early morning in June, an NBC News reporter knocked on Lisa’s door. Lisa came out to the porch and for 13 minutes answered questions about the connections between her and Naussany.

Lisa said she didn’t have a P.O. Box, and didn’t know any Naussany. She said she didn’t post photos of Easter baskets to Facebook, before remembering that she had, but only to her personal account, she said — not the one belonging to Carloyn Naussany. She said her IDs had been stolen last year and that she had filed a report with the county. (Representatives for Taney County and Stone County were unable to locate such a record.) She said that she would be taking the list of Naussany connections to the sheriff that day to file a complaint of identity theft.

And what about Graceland and the nail salon and all the links pointing back to her?

“I have no earthly idea what you’re talking about,” Lisa said.

After leaving Lisa’s porch, the reporter followed up in a text with details of each Naussany connection. When asked whether she had filed a report with the sheriff, Lisa responded with a cease and desist letter, demanding the reporter end all communication.

Within half an hour of the reporter’s visit, the Carloyn Naussany Facebook account had been deleted.

,